The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin has seen a slight reversal in its ongoing rally over the last months of 2023. This price fluctuation may nevertheless suggest an upcoming bull market as the asset finds new backers.

Throughout its entire history, Bitcoin has been a wildly fluctuating asset. In the almost 15 years since the Genesis Block was mined, its greatest valuations have always come as a result of dramatic spikes, and the comedown from these highs has always been about as steep. Nevertheless, it has always shown an uncanny tendency to end up in a better situation after the dust settles. This volatile nature has even been taken as a positive in many aspects, as it reinforces a central truth for Bitcoin: It is ultimately a currency, with a new vision for how economic relationships should operate in society. Bitcoin has gained a great deal from those who wish to treat it as a pure investment asset, but these people cannot form the heart of the community.

All this is to say, Bitcoin prices fell on December 11 after an extended bull market that lasted several months. Generally spurred on by the positive buzz around a Bitcoin ETF winning federal regulatory approval, the price continued to rise despite setbacks like the change of CEO at Binance, the industry’s largest exchange. Despite the appearance that this new rally could withstand shocks that would have been significant even a year prior, its invincibility could not last as the price dropped nearly 6% from midnight Sunday to the time of this writing. As the price hovers around the $41,000 range, a noteworthy development is the apparent lack of fear from all corners of the Bitcoin world.

Bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

Although it may seem fairly standard for the most die-hard Bitcoiners to view all price declines as a “healthy correction” or a cooldown for an “overheated” market, even more traditional financial media outlets like Barron’s have claimed that “the tea leaves in crypto derivatives still point to bullish animal spirits.” Speaking primarily about a series of potential catalysts, the esteemed weekly circulation seemed to point only to reasons that this setback is minor. In particular, it quoted FxPro analyst Alex Kuptsikevich in stating: “A wave of profit-taking hit the cryptocurrency market on Monday morning…we saw a massive exit from long positions in low liquidity… Strong demand for risk assets in traditional markets suggests that the market will try to get back on its previous growth track.”

These long positions in particular are at the crux of the recent downturn. After months of success, indirect investors showed a particular interest in risky bets where Bitcoin was concerned: These investors had a greater stomach for starting futures contracts at heavily leveraged positions. Although bets like this would be easier to set up and earn money without higher startup capital, they’d be liquidated automatically if bitcoin were to fall suddenly. A sudden drop in price was quickly able to erase some $330 million in these bets, a figure that ballooned to $500 million the next day. These leveraged positions seem as of yet to be the biggest casualties from the price drop.

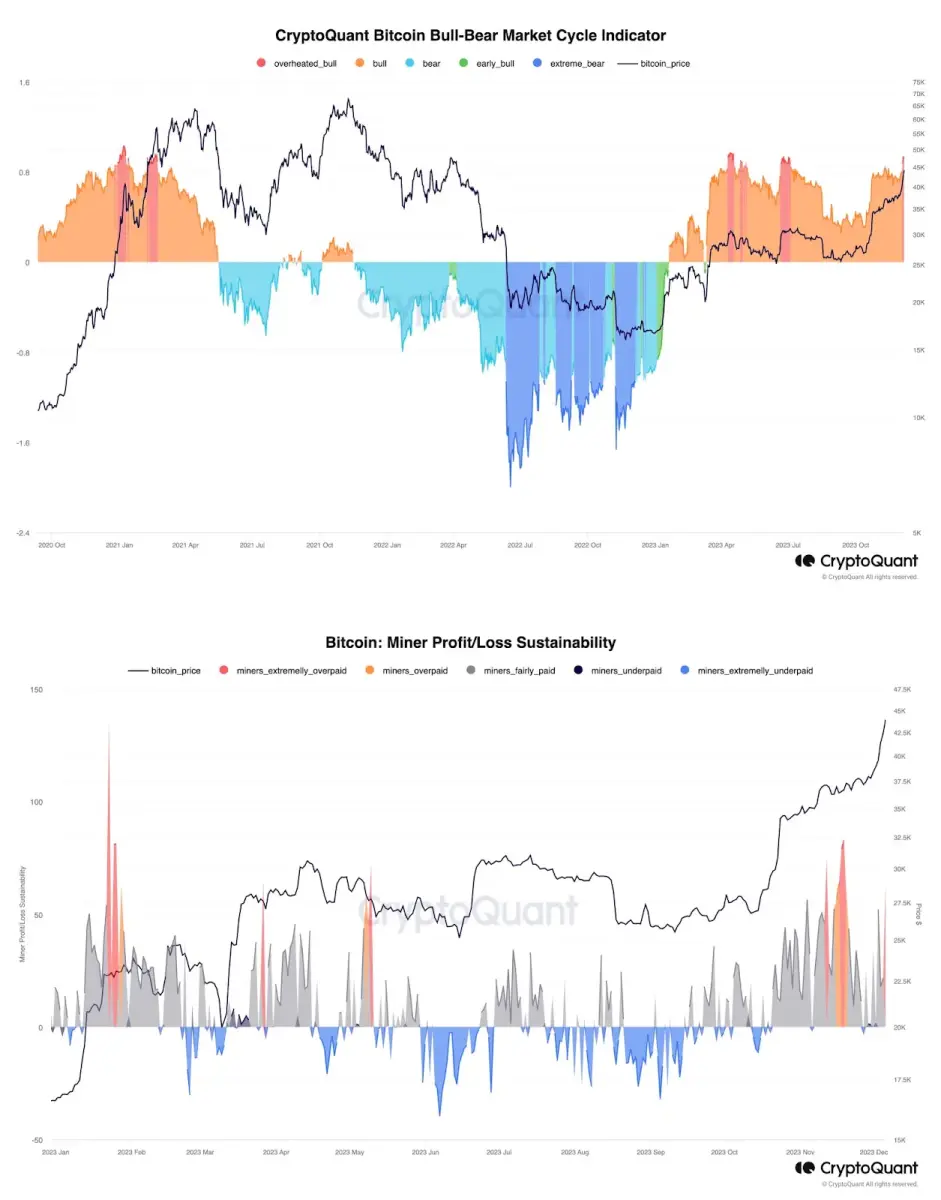

In other words, as analysts have been quick to point out, the market was just too hot. A series of figures add weight to the claim that Bitcoin’s success has encouraged these risky bets: Not only was the bull market entering historically unstable rates for the first time since before the bull market, but other factors like mining difficulty serve as canary in the coal mine. With the next halving becoming increasingly imminent, miners are in no position to expect a continued scenario where mining rewards increase faster than mining difficulty. But that’s exactly the scenario that’s been playing out.

So, although some experts have claimed that this cooling period may continue to persist as long as one month or longer, the overwhelming consensus is that the price of bitcoin will come back as hard as ever in the very near future. But why is this? Sure, a tiny setback for bitcoin doesn’t seem to hurt anybody but the overleveraged futures traders, but what can justify the real belief that, as CNBC put it, “there’s plenty of momentum left in the current bitcoin uptrend?” The answer comes from the same thing that created this momentum: a real belief in the Spot Bitcoin ETF.

Last week’s rumors that the leading ETF applicants were nearing a breakthrough in their negotiations with the SEC have turned into new negotiations: BlackRock in particular has extended a new invitation for the largest banks on Wall Street to get in on the action. BlackRock requested a change in the ETF protocol from their proposals, allowing certain authorized participants to use cash instead of bitcoin to invest. Considering that some large banks are prohibited from directly holding Bitcoin or other digital assets, this change directly opens the door for some of the largest players in the industry. An offer like this seems to further suggest that BlackRock’s talks with the SEC have stabilized to a new degree.

Additionally, Google has also updated its advertisement policies, quietly making changes to a platform that has historically had a great skepticism towards Bitcoin-related products. With certain caveats, Google will now permit the advertisement of “Cryptocurrency Coin Trusts” to users in the United States, specifically claiming that financial assets representing actual digital currency are fair game. On top of this, Google has even loosened its enforcement strategy for violations of this type, turning immediate suspension into a 7-day warning. Changes like this surely seem to suggest that the search engine giant is also expecting a forthcoming approval.

This setback, in other words, is just a natural part in the life cycle of Bitcoin, and bitcoiners appreciate that. Sometimes, the currency’s runaway success attracts newcomers that don’t fully understand that bitcoin’s volatility cuts both ways. Traders saw overleveraged positions as a cheap way to potentially win large sums of cash from bitcon’s price rally, and now a temporary setback has caused hundreds of millions to evaporate. But this is nothing new. Downturn phases like this keep the market from growing too unsustainably for too long, and ensure that anyone who’s interested in Bitcoin for very long will appreciate more than a quick chance for profit. Bitcoin’s capacity for meteoric rise is what brings people into the fold, and meteoric declines are what temper their expectations. Through all of these moves, Bitcoin only grows in strength.