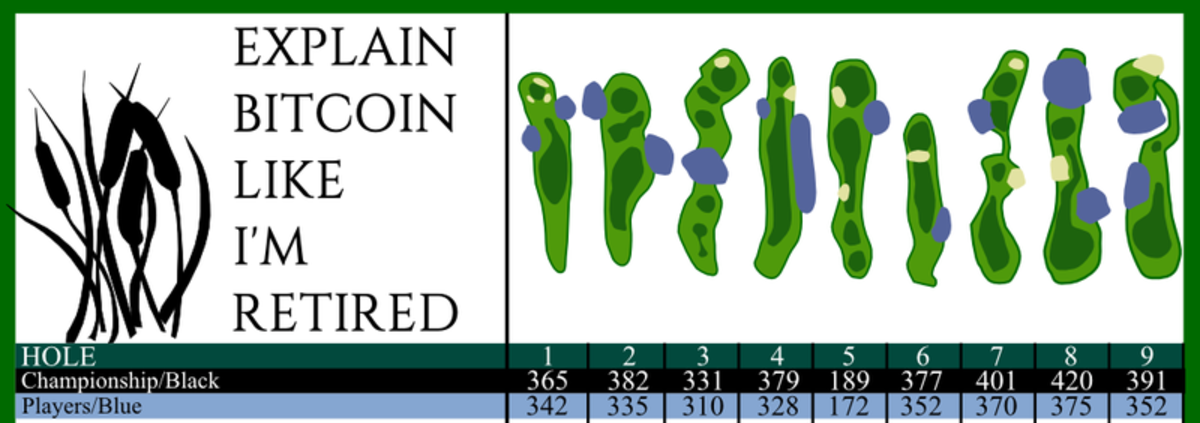

This article is intended as an introduction to the concepts of bitcoin that might be of interest to those people that are retired. The reader is expected to have only basic internet web browsing and email knowledge. The questions and answers are given in “layman” terms.

What is Bitcoin ?

Bitcoin is a new kind of payment and currency system. It’s a new way to pay for things with using pre-paid credits. It’s different from credit cards because it’s not based on debt. It’s the next generation of transferring money that replaces past inventions of using checking accounts and credit cards. It allows you to pay with cash-like money over the internet, even when they are standing next to you. With this new invention, credits of value that are stored on a ledger shared and verified by everyone, everywhere, at once, all around the world. It’s the first verifiable accounting systems that doesn’t belong to any government, bank, or king. Therefore it’s the first accounting system that belongs to nobody, so it can be verified and trusted by everybody. It’s the first time in history this has been possible.

The term is bitcoin – but it’s not really a coin – it’s just a block of pieces of value now being called bits. The term of the currency called a ”bitcoin”, is just another name for one million bits: just like a dollar can be called one hundred pennies. They have a lot of unique qualities that make them like no other currency that has come before. One of the biggest benefits is that it acts like money and has value. To be valuable it must remain scarce and desirable. Bitcoin is also a money payment system maintained by a world wide community. One of the main rules of the system is that only a limited quantity can ever be created, and that law can never change. A limited supply with exploding demand makes it become valuable.

People and companies all over the world have started to accept bitcoin as an equal to cash or credit cards. Merchants are helped by companies who will convert the bitcoin payments right back to cash at the time of sale. This is very good for the merchant because they don’t have to pay credit card fees or worry about getting stuck the bill because credit card fraud.

But what about the government…and banks?

The US government wants desperately to maintain the nation’s technology lead in creating new businesses that the world uses. Google, Facebook, and Apple are a few examples. They are excited to see all the new businesses that are starting up and the hundreds of millions of dollars being invested. This is new growth and jobs that the US needs.

Even the Federal Reserve Bank recently showed excitementabout the new possibilities despite that fact that it can remove some of the functions that banks do. Electronic payments and checks can be done by bitcoin automatically and almost free without a lot of banks getting in the way. One world-wide ledger that everybody can trust will handle that. Than banks themselves will benefit because their old ways of sending money to each other hasn’t improved since the 70s. It still takes them up to five business days just to wire funds across the street. Bitcoin can transfer money all over the world in less than 10 minutes for almost free. Understandably, some banks are nervous about change, but the need for banks won’t be going away; people will still need to get loans to start new businesses, buy cars and houses. Banks are going to have to adapt and find new ways of being useful.

Many other countries don’t understand bitcoin yet. Just like most people, some governments are a little afraid of technologies they don’t understand. A lot of countries are a little slower to catch on but tend to follow the USA’s lead when it comes to world-changing technologies. The US didn’t invent bitcoin (that we know of) but seems to be out in front of other governments right now in the race to the future. Other countries seem to be slowly coming around. They have a duty to remind their citizens that there aren’t laws on the books yet for bitcoin technology because it never existed before. Some have told their citizens watch out for bad businesses and criminals trying to trick people out of their bitcoin. They remind their population that bitcoin isn’t legal tender – just like all the currencies of every other country outside its borders. Just try to pay your parking fine using Mexican Pesos and you’ll see how that works.

What about bad guys – aren’t they using bitcoin?

Yes, they have. They were some of the first to realize the benefits of using bitcoin for transferring money. They were one step ahead of the police and courts who didn’t know about it or understand it yet. It would be a few years before they would figure out how to stop crime with it. Some authorities around the world also continue to fear twitter and email because “bad people” can communicate. As we have learned, not all police around the world are the good guys. These days, the police have been using it to stop thieves because bitcoin can leave a trail of breadcrumbsforever recorded on the ledger.

TheUS government said bitcoin hasn’t been used much for crime at all compared to regular cash because not everybody accepts bitcoin yet. Bad guys still need cash to pay for bribes, and guns and other bad guy stuff. But big online bitcoin exchanges have gone down and taken a lot of customer’s money with them. Governments don’t have laws on the books yet to make sure big exchanges are insured and audited like regular money exchanges. Partners in crime will likely be afraid that the money trail that might lead back to them as well. Some of the authorities have said they would rather the crooks use bitcoin because it’s easier to follow than cash. The US officials don’t believe terrorist will be much interested.

Somebody told me it’s a scam. Is it a ponzi scheme or something?

No. Ponzi schemes wouldn’t be considered legitimate by the Federal Reserve Bank, governments around the world, or big investment companies spending hundreds of millions getting new companies formed. The bitcoin system isn’t owned by anybody yest everybody in the world can use it. There is no “pyramid” because there is not center or middle – it is decentralized. If one studies closely, they would likely find that the only people saying that today are the same people who understand it the least. Nobody should be promising that you’ll make money with bitcoin. It is very new and that can become valuable, but it can also be risky. If this technology really is changing the paradigm of the world, it might be fair to ask…wouldn’t that to be expected?

Like any investment in a new technology or company, the people that invest early are better off than those who invest late. Just ask early Google investors, or Microsoft and Apple, or railroad companies. That’s the nature of investing. As things become more popular, more people want to use them which creates more interest and it builds on itself. Just like the telephone wasn’t worth much when only five people in the world used it. But now how much are cellphone companies worth? We see this happen all the time with new technologies that change the world. Only this time it’s the nature and abilities of money itself that is changing.

Where do you buy bitcoin?

You can buy bitcoins from several companies on the internet. Some of them will even connect right to your regular banking account so you can trade back and forth between bitcoin and dollars whenever you want in the United States. The two easiest places right now are coinbase.com and circle.com. They will allow you to connect your bank right to their banking system to transfer dollars to bitcoins and back when you want.

They will also store it and protect it there so you don’t have to worry about people trying to steal it from you. Many companies have gone out of business and the people lost their money that trusted them. Coinbase.com has proven to be very respectable. Circle.com is brand new but is backed by very important people with good track records and reputations.

Things to know first:

The price of bitcoin goes up and down by huge amounts that make it unpredictable right now. This is common for new world-changing technologies at first. But when you take a step back and look at the price over a year’s time at every point, it has always gone up. That doesn’t mean it always will, but there are reasons to believe it will. People are learning new ways to use them and it’s creating more excitement. Sometimes the excitement gets ahead of itself and when calmer heads prevail the price adjusts downwards very quickly as people see a price drop and panic. A lot of people are still skittish about new technology but trust is growing and the price swings are getting smaller. Now big Wall Street companies are starting to invest, the huge price swings may calm down.

It’s also a good idea for seniors to leave bitcoin with these bank-like companies (Currently coinbase.com and circle.com) because they are the kind that are audited and insured. This verifies they are protecting your bitcoin and still have it in their possession and can send it back to you, or convert it back into regular dollars if you want. They protect it by storing most of it disconnected from any networksand use several secure storage locations around the world with security guards. There are also other good honest companies for more technical people. And there have been a lot of companies that have gone out of business or have been raided by thieves. For now, coinbase.com has proven to be excellent and easy. Circle.com may also be good to look into as they open for business

I Don’t plan on spending bitcoins. Why would I want any?

The technology has a way to go to become friendly and easy enough for many people that haven’t grown up using new technology all their lives. Some of the retirement population might consider buying a little as a small investment. They should be reminded that it’s still considered risky investment still because the technology is still very young. It’s possible that there could be something that breaks that nobody has thought of yet. But a lot of people have realized that if it continues to work, it could be extremely valuable over time. The price has gone up thousands of percent. If seniors think about putting a little money into bitcoin, it should be money they wouldn’t lose sleep over if the price went to zero. You can buy as little as $5.00 so there’s no need to make a big investment.

Some people consider it an investment in the future of a new kind of money system. They believe that putting a little money aside here is a bet on the prediction that the rest of the world will eventually catch on to this new invention. It has dozens of benefits over older kinds of money that have been around for centuries that couldn’t have existed until this time and place inf the world. People living on fixed incomes see that the price of what they need is going up faster and each dollar they own buys less. Owning a little bitcoin might help protect some of the value of their money. If the price and value continue to increase as many experts predict, some people may considering buying a little as an insurance policy for their money.

Sources:

https://bitcoin.org/en/development

http://www.coindesk.com/federal-reserve-bitcoin-potential-boon-global-commerce/

http://www.americanbanker.com/magazine/124_02/why-bitcoin-matters-for-bankers-1065590-1.html

http://en.wikipedia.org/wiki/Legality_of_Bitcoins_by_country

http://www.coindesk.com/argentine-central-bank-issues-warning-burgeoning-bitcoin-ecosystem/

http://www.nytimes.com/2014/02/27/opinion/27iht-edlebedev27.html?_r=1

http://www.usatoday.com/story/news/nation/2013/10/21/fbi-cracks-silk-road/2984921/

http://www.investopedia.com/articles/investing/052014/why-bitcoins-value-so-volatile.asp

http://fortune.com/2014/04/02/secondmarket-ceo-barry-silbert-banks-cant-ignore-bitcoin-anymore/

http://support.coinbase.com/customer/portal/articles/628970-how-does-coinbase-handle-security-

http://www.marketwatch.com/story/my-risky-retirement-bet-in-bitcoins-2014-05-27

http://dealbook.nytimes.com/2014/01/21/why-bitcoin-matters/

You Say Bitcoin Has No Intrinsic Value: https://bitcoinmagazine.com/articles/say-bitcoin-intrinsic-value-twenty-two-reasons-think