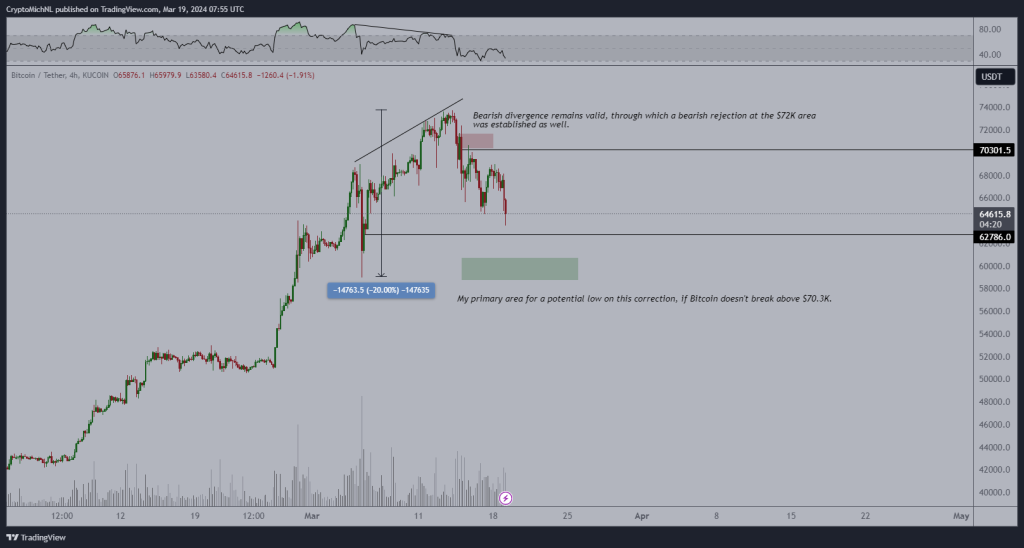

One analyst on X now thinks there is a high chance that Bitcoin will drop from spot levels to as low as the $59,000 to $62,000 support zone if bulls fail to reclaim $70,300. The drop will represent a 20% drop from all-time highs of $73,800.

Eyes On FOMC After BoJ Shocker

The analyst noted a “valid” bearish divergence formation in the Bitcoin daily chart. Whenever a divergence forms, it means that there is a disconnect between price and momentum. With bears currently in command, forcing prices lower, the odds of prices falling even lower beyond the current lows appear elevated.

For the ongoing uptrend to persist and for bulls to breathe a sigh of relief, a robust close above $70,300 is necessary. This potential upswing could decelerate the current sell-off and align prices with the dominant trend over the past few months.

The trader’s evaluation indicates that several fundamental factors will shape the short-to-medium-term price trajectory. The most significant of these is the anticipated direction of monetary policy from the imminent Federal Open Market Committee (FOMC) meeting in the United States on [March 20], which could substantially impact Bitcoin’s price.

Ahead of this meeting, the Bank of Japan (BoJ), the central bank of Japan, raised interest rates for the first time since 2007, sending shockwaves across the market. That the BoJ is raising rates means the global financial conditions, despite optimism, are still tight. Of note, inflation in the country rose. However, the central bank said they plan to keep interest rates at the current levels as long as “financial conditions” remain constant.

Grayscale Selling More Bitcoin, Spot ETF Demand Waning?

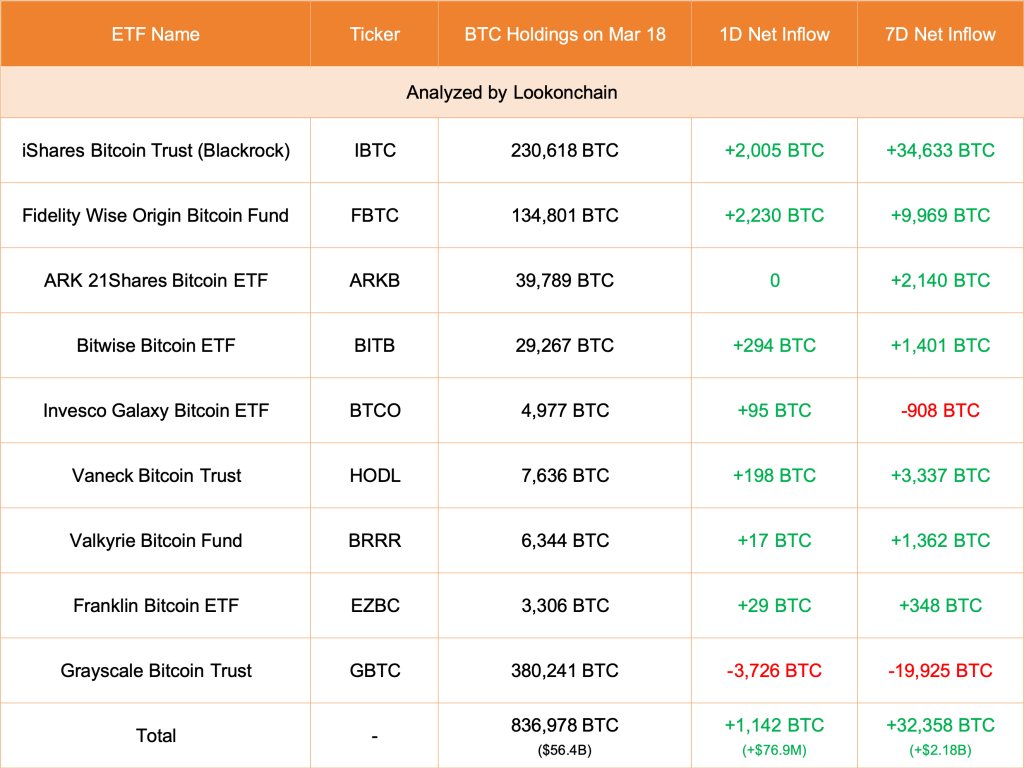

Aside from monetary policy, analysts highlight that recent outflows from Grayscale, amounting to approximately $154 million on March 18, resulted in a total outflow for the first time since March 1. Data from Lookonchain indicates that Grayscale, winding down its Grayscale Bitcoin Trust (GBTC), released more coins than other spot Bitcoin exchange-traded fund (ETF) issuers purchased.

Concurrently, the influx of capital into spot Bitcoin ETFs seems to be diminishing, a development that could be bearish for BTC.

Since its launch in January 2024, Bitcoin prices have been primarily propelled by demand for spot ETFs.

For now, Bitcoin prices remain under immense selling pressure. The coin is edging lower, closer to the $60,000 round number. Whether or not bears will continue pressing prices lower remains to be seen. However, the broader crypto market remains bullish, and the upcoming halving event is expected to stir demand and lift prices.