On-chain data shows that Bitcoin long-term holders don’t care too much about the ongoing market FUD as their exchange inflows remain very low.

Bitcoin Long-Term Holder Inflows Have Remained Muted Recently

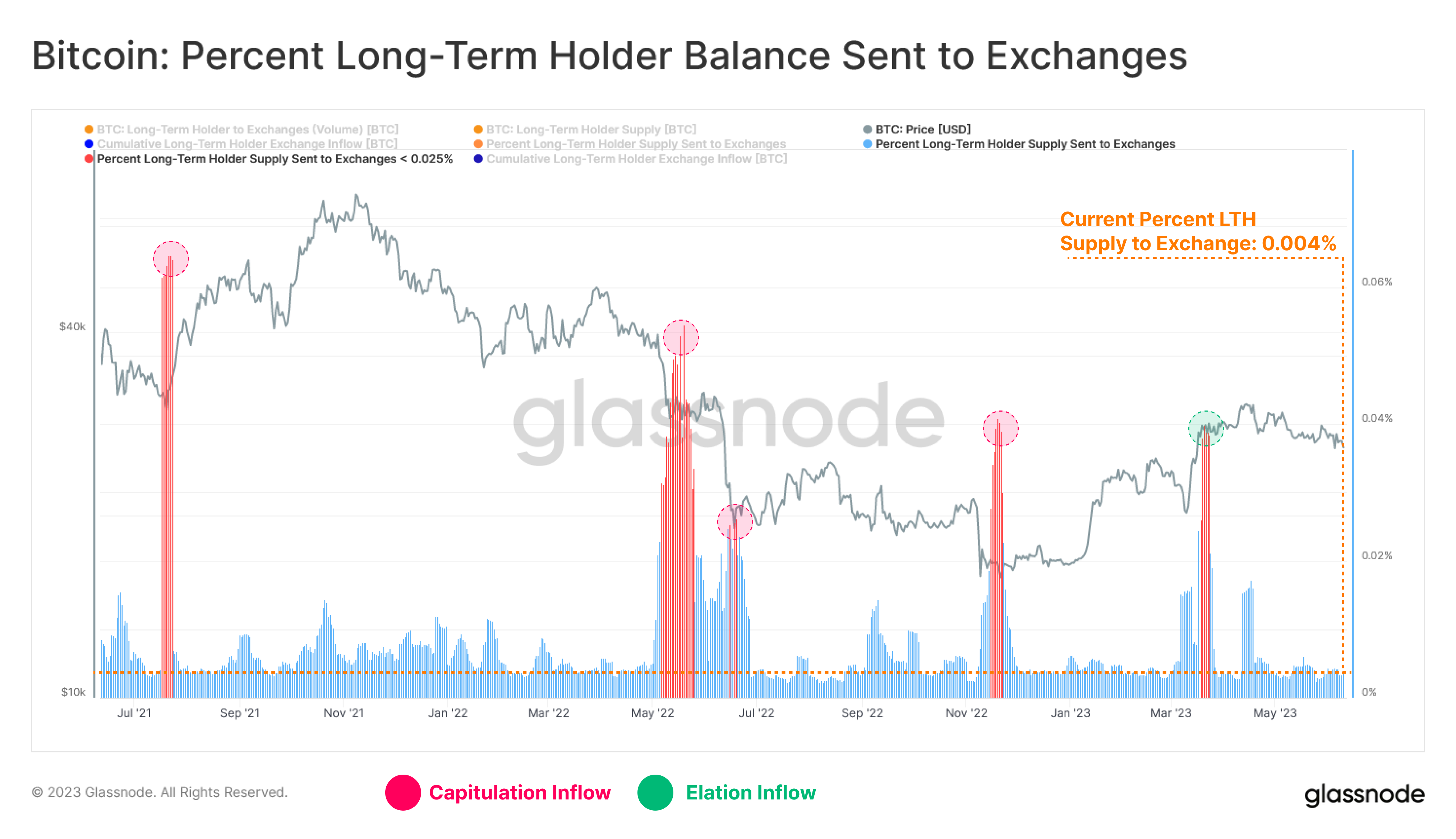

According to data from the on-chain analytics firm Glassnode, the long-term holders have only been depositing around 0.004% of their supply to exchanges recently. The “long-term holders” (LTHs) here refer to investors who have been holding onto their coins since at least 155 days ago.

The LTHs make up for one of the two main segments the Bitcoin market is generally divided in, with the other cohort being the “short-term holders” (STHs). Naturally, the STHs are holders who acquired their BTC less than 155 days ago.

Statistically, the longer an investor holds onto their coins, the less likely they become to less at any point. This means that the LTHs are usually less probable to participate in selling, while the STHs are the weaker hands who might easily sell. This resilience of the LTHs has earned them the nickname the “diamond hands.”

Recently, the Bitcoin market has been taken over by FUD due to the regulatory pressure that the US Securities and Exchange Commission (SEC) has put on the cryptocurrency exchanges Binance and Coinbase.

Amid such market uncertainty, it’s not unthinkable that the STHs would be doing some dumping. The LTHs, of course, would be expected to show a stronger conviction.

To see how the LTHs might be coping with the current situation in the sector, Glassnode has looked into the exchange inflow data for the group, as exchanges are what investors generally transfer their coins to when they want to sell.

The below chart depicts the recent behavior of these holders.

Here, the exchange inflow of the Bitcoin LTHs is represented in terms of the percentage of the combined supply held by these diamond hands. From the graph, it’s visible that this indicator’s value has been at very low levels recently. This would imply that these investors have been taking part in little amounts of selling during the past few days.

Currently, the LTHs are making deposits equivalent to just 0.004% of their supply. The analytics firm has also highlighted the previous major selloffs that these investors had participated in, to see how those values compare with the ones being observed right now.

Clearly, the current spike in the indicator is nowhere near the scale of the spikes observed during the last couple of years. Both the selloffs following the FTX collapse and the March 2023 recovery rally, for example, saw the LTHs depositing at least 10 times the percentage of their supply as right now.

It would appear that unlike previous FUD events like the LUNA collapse or the 3AC bankruptcy, the Bitcoin LTHs aren’t particularly bothered by the current distress in the sector.

BTC Price

At the time of writing, Bitcoin is trading around $25,900, down 3% in the last week.