Data shows the Bitcoin supply older than 1 year has hit an all-time high, showing that the asset’s diamond hands are holding strong through the rally.

Bitcoin Long-Term Holders Don’t Budge Despite The Rally

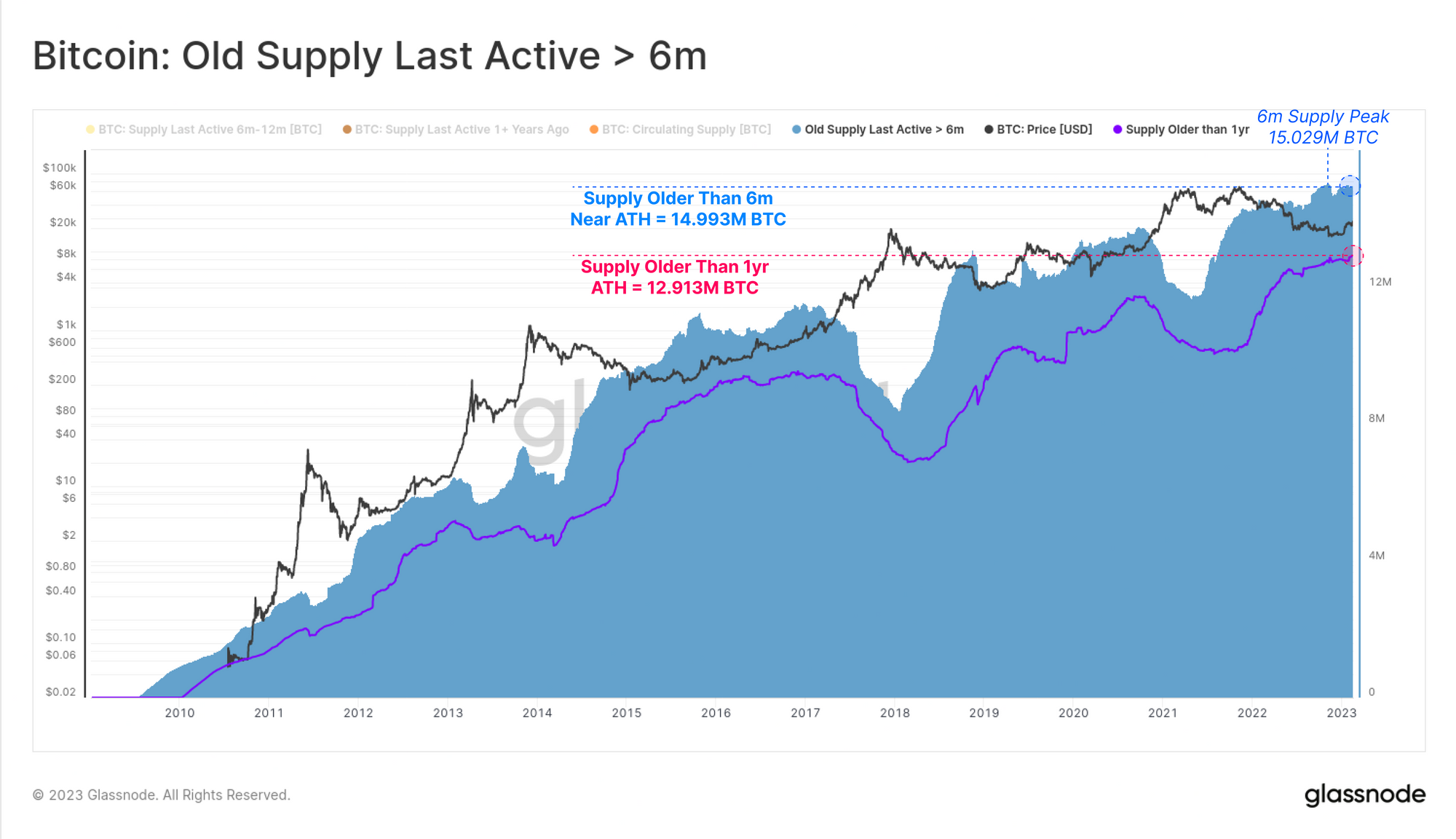

According to the latest weekly report from Glassnode, the supply older than 6 months is also near an ATH right now. There are two Bitcoin metrics of relevance here, the “supply older than 6 months” and the “supply older than 1 year.”

As their names already suggest, these indicators include coins that have been sitting dormant (that is, they haven’t been moved or sold from a single wallet address) since more than their respective time cutoffs.

Generally, any investor who has been holding onto their coins since more than 6 months ago is included in the “long-term holder” (LTHs) group. This means that both the supplies of interest here (6 months+ and 1 year+) would include these holders.

Statistically speaking, the longer a token stays dormant on the blockchain, the less likely it becomes to be sold at any point. As the LTHs hold onto their coins for such large periods, they don’t easily sell and are thus referred to as the resolute “diamond hands” of the market.

Now, here is a chart that shows the trend in the amount of the Bitcoin supply held by these LTHs, for two different starting cutoffs:

As displayed in the above graph, the Bitcoin supply older than 6 months had seen some decline around the FTX collapse, showing that some of these LTHs had been put under enough pressure to capitulate during the crash.

The supply older than 1 year, however, didn’t notice any significant drawdown during the price plunge, suggesting that it was mostly the holders with coins aged between 6-12 months that ended up dumping in the crash. This trend could be looked at as an illustration of how the older coins are generally harder to budge.

Since the crash, both of these supplies have observed an uptrend, with the 1 year+ hitting a new ATH of 12.9 million BTC, while the 6 month+ is almost at one as its current value is about 14.9 million BTC (last ATH was north of 15 million BTC).

Interestingly, these supplies have only either moved sideways or up since the latest rally in the price of the asset started. This implies that even the 50% year-to-date (YTD) profits haven’t been able to push these LTHs into participating in some profit-taking, showing that these investors potentially hold some strong bullish conviction about the cryptocurrency right now and may expect even greater returns in the future.

BTC Price

At the time of writing, Bitcoin is trading around $24,600, up 13% in the last week.