Bitcoin developer Luke Dashjr has confirmed that a prototypes Butterfly Labs ASIC is now hashing. The device is still far from full capacity, pushing out only 25 GH/s at a power consumption of 180 watts, but this is nevertheless the first definitive proof that Butterfly Labs is producing a legitimate product, and is not too far from finally releasing its first batch.

Butterfly Labs’ Josh Zerlan also recently provided updates on the state of Butterfly Labs’ production in an IRC channel. The core of the conversation is this:

BFL_Josh: Well guys, I had planned on updating everyone with a video of a board hashing here in KC tonight, but I haven’t been able to get that together yet, so I’m probably going to have to push it off until tomorrow. We are targeting a start of shipment next week, but I’m not quite ready to commit to that at the moment, given our past estimates. It’s imminent, though.

Lab_Rat: It hashes????

BFL_Josh: Yes, it hashes

Further down in the conversation, Zerlan provides the main reasons for the current delay. Zerlan writes: “We may miss our power targets, that’s been part of the hold up… we think there’s a problem with the power consumption and we’re trying to figure out where it’s having an issue … What’s causing even more consternation is the fact that the wafer we burned for tests runs at far less power than a second wafer we mounted on the BGA package… so it may be a wafer by wafer thing, and since we only have two datapoints, it’s hard to nail down the issue.” To many in the field, these difficulties are unsurprising; in mid-January, Avalon founder Yifu Guo wrote on the topic “recently they changed it to 1.2W, but they won’t even reach that. We ran 65nm simulations and they should be around 3W.” But to many of Butterfly Labs’ customers, who have now suffered from six months of delays, power consumption does not even matter; given that every extra day represents a lost opportunity for profit that will never come back, almost any level of power consumption is acceptable if it means that the devices will ship faster.

Butterfly Labs’ shipment has been awaited by the community for nearly ten months; the company was in fact the first to start accepting pre-orders in June 2012. Although the original shipping date was scheduled for October, the company suffered a number of delays that changed their expected shipping date first to late November, then early January, then mid-February and finally where it is today. In the meantime two other major ASIC producers, Avalon and ASICMiner, have also started hashing, and are partially responsible for raising the network hashpower from 20 TH/s to 55 TH/s over the past three months (the other contributing factor being the rapidly increasing BTC price). However, the community is still watching Butterfly Labs intently for one key reason: its potential hashpower. Although the output of Avalon and ASICMiner has been small, with Avalon’s first release being 20 TH/s and ASICMiner’s launch 12 TH/s, Butterfly Labs’ preorders altogether make up over 60 TH/s – more than is currently on the entire Bitcoin network.

For the security of the Bitcoin network, it is arguably quite fortunate that Butterfly Labs has been delayed by so much; if their machines had come any earlier, or even today, the company would have had access to more hashpower than the rest of the entire Bitcoin network put together, fundamentally compromising a key assumption of Bitcoin’s security. This threat was a major reason why Avalon founder Yifu Guo decided to go ahead with his project; “that was our main goal – we wanted to prevent this potential monopoly,” Guo wrote in a recent interview. However, it turned out that the major providers released in just the right order; Avalon started shipping their first, 20 TH/s, batch first on Jan 19, although all but two of their devices were delayed by many weeks after that date. ASICMiner started hashing on Feb 14, starting off with 2 TH/s and slowly ramping up over the past two months, and over these past two months hundreds of anonymous GPU miners turned on their hardware because of the increased mining profitability from Bitcoin’s rapidly growing price.

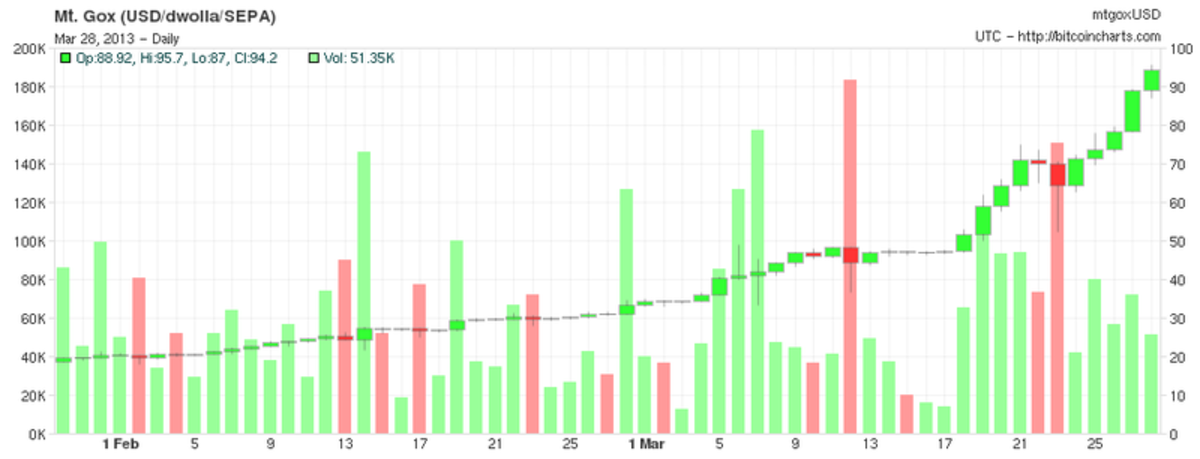

The rapidly rising Bitcoin price has been a massive boon to the Bitcoin mining industry in general. Since the beginning of the year, the Bitcoin price has risen from $13.3 to over $100, making mining extremely profitable for those lucky enough to have the hardware to do it. The fact that Bitcoin mining is now so heavily focused on specialized hardware compounds the advantage; while in 2010 or 2011 such price increases were quickly met with large numbers of off-the-shelf GPUs joining the network, now the most powerful miners are all specialized devices, and production takes months to compensate for the increased demand. When Jeff Garzik received Avalon’s first ASIC at the end of January, the device paid for itself in nine days, and its profitability since then has only increased. As a result, Avalon has raised the price on their third batch to 75 BTC, or $7,500, and has nevertheless sold a significant number of units. Because ASICMiner is not selling their hardware, instead selling shares and doing mining in-house, they can benefit from the increased value of their revenues directly. Notably, Butterfly Labs has not increased their prices, but even if they continue to keep their prices the same they will still benefit massively from increased sales.

In the next few months, Bitcoin network hashpower will only continue to increase. Avalon’s three shipments altogether will make up a total of 1500 units, or over 75 TH/s, and ASICMiner is planning 50 TH/s by the end of April, and 200 TH/s soon after. By the end of the year, ASICMiner’s friedcat writes on Bitcointalk, ASICMiner’s total hashpower may be as high as 1000 TH/s, and friedcat even adds that “some may say that 1,000TH/s at the end of this year is too conservative.”