On-chain data shows the Bitcoin active addresses have broken above the levels seen in Nov. 2021, suggesting that demand for BTC is surging.

Bitcoin Active Addresses Have Observed Constant Growth Recently

As an analyst in a CryptoQuant post pointed out, there were concerns in February that the metric hadn’t been displaying any significant growth. The “active addresses” is an indicator that measures the daily total number of Bitcoin addresses participating in some transaction activity on the blockchain.

Naturally, this metric accounts for both senders and receivers in this measurement. It also only includes unique addresses, meaning that any addresses making repeat transactions are counted only once. Because of this, the metric can give an idea about the number of users using the blockchain daily.

When the value of this indicator is high, it means many addresses are making transfers on the network right now. Such a trend suggests that the blockchain is currently observing a high amount of usage.

On the other hand, low values imply that network activity is low. This trend can indicate that the general interest in the cryptocurrency is low among investors.

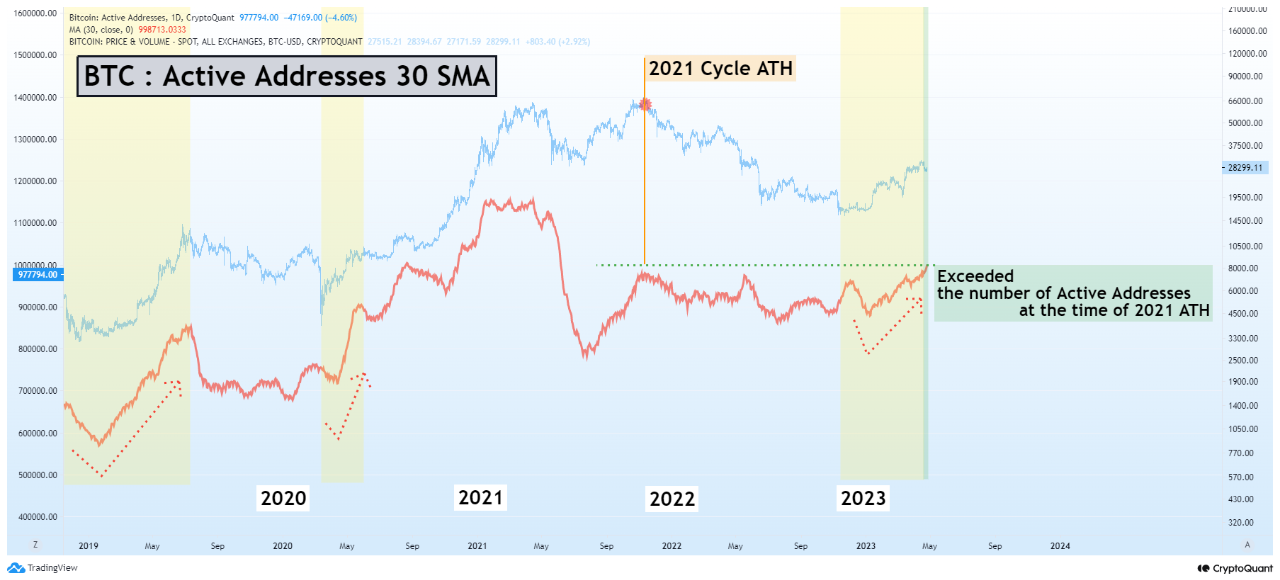

Now, here is a chart that shows the trend in the 30-day simple moving average (SMA) of Bitcoin active addresses over the last few years:

As shown in the above graph, the 30-day SMA Bitcoin active addresses metric had mostly moved sideways during the 2022 bear market. This is usually the pattern noticed in bearish periods, as investors find the endless consolidation typically associated with such periods boring, so only a few participants on the blockchain.

However, highly volatile events like crashes do see many users becoming active. They rush to sell their coins to cut their losses or attempt to catch the bottom. An example of this happening can be seen in the chart during the November 2022 FTX collapse.

A similar effect is usually seen with rallies, but the price surge that started this year initially observed little growth in the active addresses. This raised concerns about the sustainability of the rally, as all extended price moves have historically required large amounts of daily traffic to keep going.

Recently, however, it has become clear that the indicator has been seeing some constant, gradual growth, suggesting that trading interest in the asset is slowly but surely going up.

Recently, the 30-day SMA Bitcoin active addresses metric has broken above the levels observed during the November 2021 price all-time high, showing that there is now a significant amount of demand for the cryptocurrency in the market.

BTC Price

At the time of writing, Bitcoin is trading around $29,700, up 1% in the last week.