The Bitcoin and crypto market is holding its breath in anticipation of the week ahead, particularly due to a singular, critical event: the US Federal Reserve’s interest rate decision followed by the FOMC press conference featuring Fed Chairman Jerome Powell. This looming decision has the potential to ripple through all financial markets, from Wall Street to the decentralized corridors of Bitcoin and crypto.

Other events that could have an the potential impact the market are rather rare. Only the already last week approved liquidation of the FTX holdings (maximum $100 million, $200 million per week under certain circumstances) could be news-worthy. However, since the liquidations do not require any announcements, there will be no big headlines.

FOMC And Interest Rate Decision On Wednesday

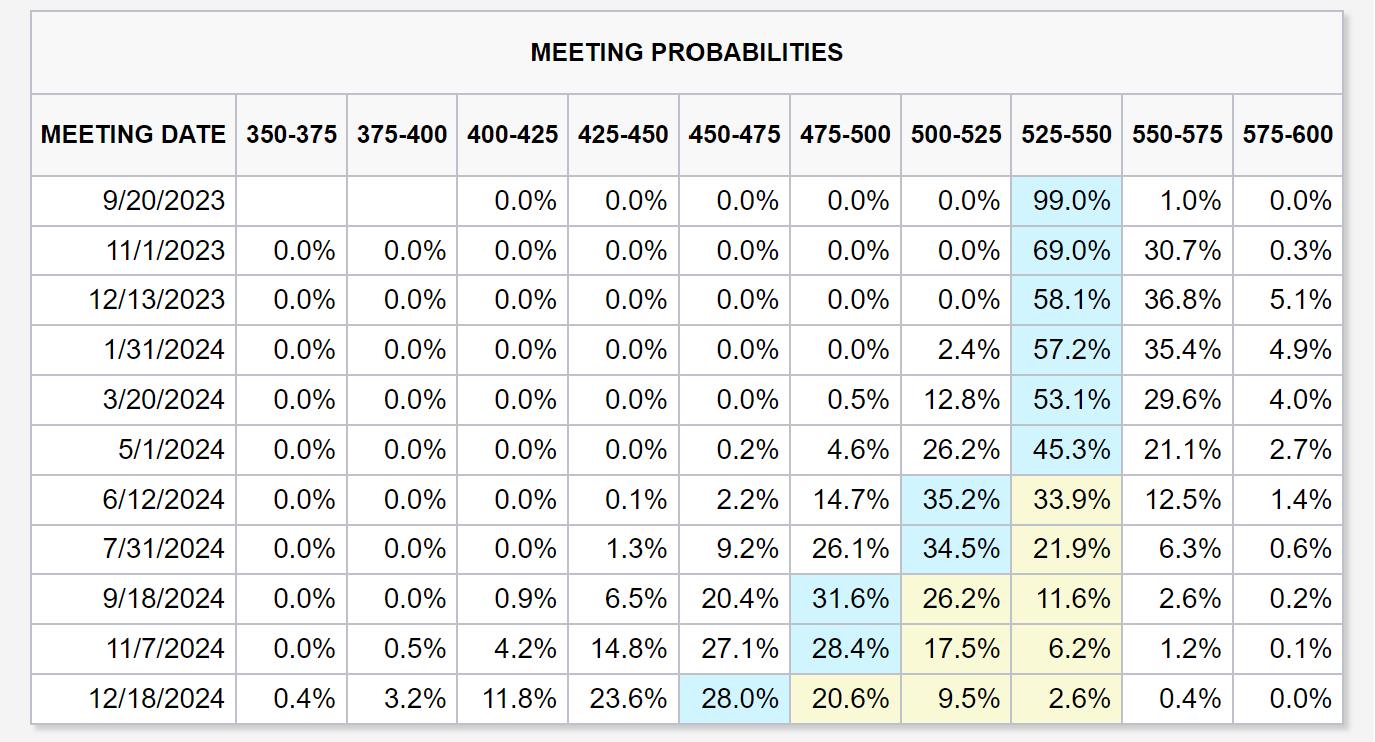

The Federal Open Market Committee (FOMC) is scheduled to convene on September 20, and market participants are highly optimistic that a pause on interest rate hikes will be announced. Current market data suggests an overwhelming 98-99% likelihood of rates remaining stable, according to the FedWatch Tool.

If this expectation holds true, it would mean the Federal Reserve maintains the benchmark Fed funds target range between 5.25% and 5.50%—the highest level since January 2001. Following the rate decision, the market will keenly focus on Fed Chairman Jerome Powell’s subsequent speech for any nuanced insights into future monetary policy.

The FOMC is also expected to release new forecasts for interest rates and economic growth, often referred to as the ‘dot-plot’. The release has the potential to be the most important market driver of the entire event. The question is: How do we assess the economic situation in the USA? When will the first interest rate cut occur?

With inflation still noticeably above target levels, and recent data revealing a 0.5% year-over year increase in CPI (from 3.2% to 3.7%) and the second increase in a row (headline CPI bottomed in June at 3.0%)—there is an increasing expectation that the Federal Reserve might adopt a hawkish tone, keeping the door open for potential rate hikes in the coming months.

Remarkably, the market is also worried the unusually large gap between U.S. GDP and GDI (Gross Domestic Income), the largest ever recorded. This scenario eerily parallels conditions seen prior to the 2008 financial crisis, stoking fears and speculations about the health of the U.S. economy and the global economic landscape at large.

THE PLOT THICKENS!

After revisions we now have the LARGEST gap between GDP and GDI on record.

The last time we had a similar gap?

2008… pic.twitter.com/UOgPpJA5i9

— AndreasStenoLarsen (@AndreasSteno) September 18, 2023

Bitcoin Price Considerations

As always, crypto investors are on high alert for any macroeconomic events that could impact the digital asset market. The general sentiment points towards Bitcoin being significantly influenced by the outcomes of the FOMC meeting and Powell’s ensuing comments.

Renowned market analysts have already weighed in on Bitcoin’s price trends. Material Indicators, a notable trading analysis account, tweeted: “That’s the first green Weekly candle close for Bitcoin in 5 weeks… FOMC rate hike announcement on Wednesday, so expect a few whale games to break up the chop.”

On a similar note, MacroCRG, another influential trader, warned of the volatility that could ensue after the FOMC meeting while highlighting the generally positive but precarious outlook for Bitcoin. “Aye spot premium increasing + funding decreasing. It actually looks good. But its Monday (Monday moves aren’t to be trusted) and we got FOMC on Wednesday,” he stated.

Michaël van de Poppe, a highly regarded analyst, also pointed to Bitcoin’s current bullish position above the 200-Week EMA (Exponential Moving Average), likening the market conditions to the 2015/2016 price cycle of the digital currency.

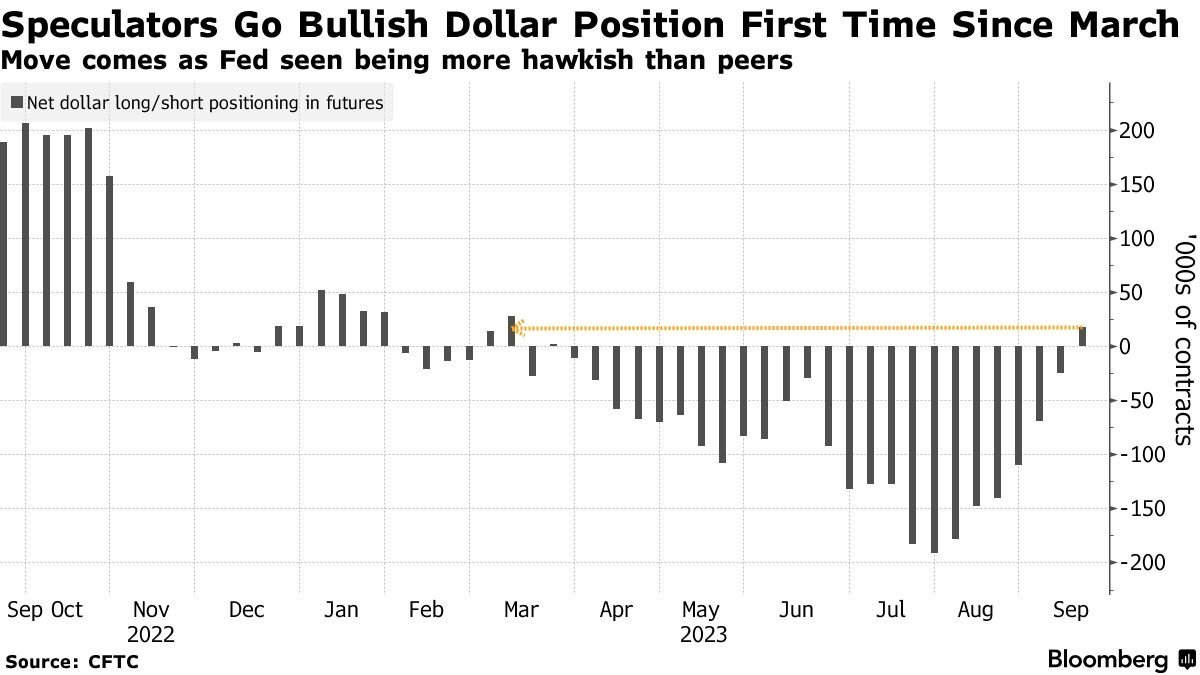

Moreover, the market is also watching the performance of the US dollar (DXY) carefully. Interestingly, hedge funds are now net long the US dollar for the first time since March. Given the inverse correlation between the US dollar and Bitcoin, a rising US dollar index could lead to selling pressure on Bitcoin.

However, the current situation still offers something special. The recent rise in the US dollar and the associated repositioning of hedge funds can be explained primarily by the weak euro following the ECB decision. Therefore, in smaller time frames Bitcoin has not shown an inverse correlation with the rise of the US dollar, as detailed by analyst Furkan Yildirim.

At press time, BTC surged by almost 2% in the last 4 hours, trading at $27,136.