The upcoming week once again holds important economic data and events for the Bitcoin and crypto market that traders should follow. Last week, Bitcoin hit a new yearly high of $28,921 before US Federal Reserve (Fed) chairman Jerome Powell wiped out the rally with his hawkish comments during the FOMC press conference.

This week, in addition to some key economic data, the US banking system will again be in focus. The banking sector in the US and also in Europe (after the Credit Suisse bailout) remain under pressure.

The Fed reported last week that US banks raised $475 billion in the wake of the banking crisis. In the two weeks since the SVB collapse, over $500 billion has also been withdrawn from small banks.

Small, regional US banks in particular continue to suffer, while large banks being the winners of the banking crisis. According to the Wall Street Journal, nearly 200 banks are still struggling with the same problems as Silicon Valley Bank (SVB).

In the second week of March, deposits at small banks fell $119 billion

Deposits at large banks increased by $67 billion the same week pic.twitter.com/NKxR5p9xsD

— Genevieve Roch-Decter, CFA (@GRDecter) March 26, 2023

Meanwhile, there is still no solution. Last week, Treasury Secretary Yellen said the US was considering backing all deposits. A day later, she reversed her statement and said that the government is no longer considering doing so.

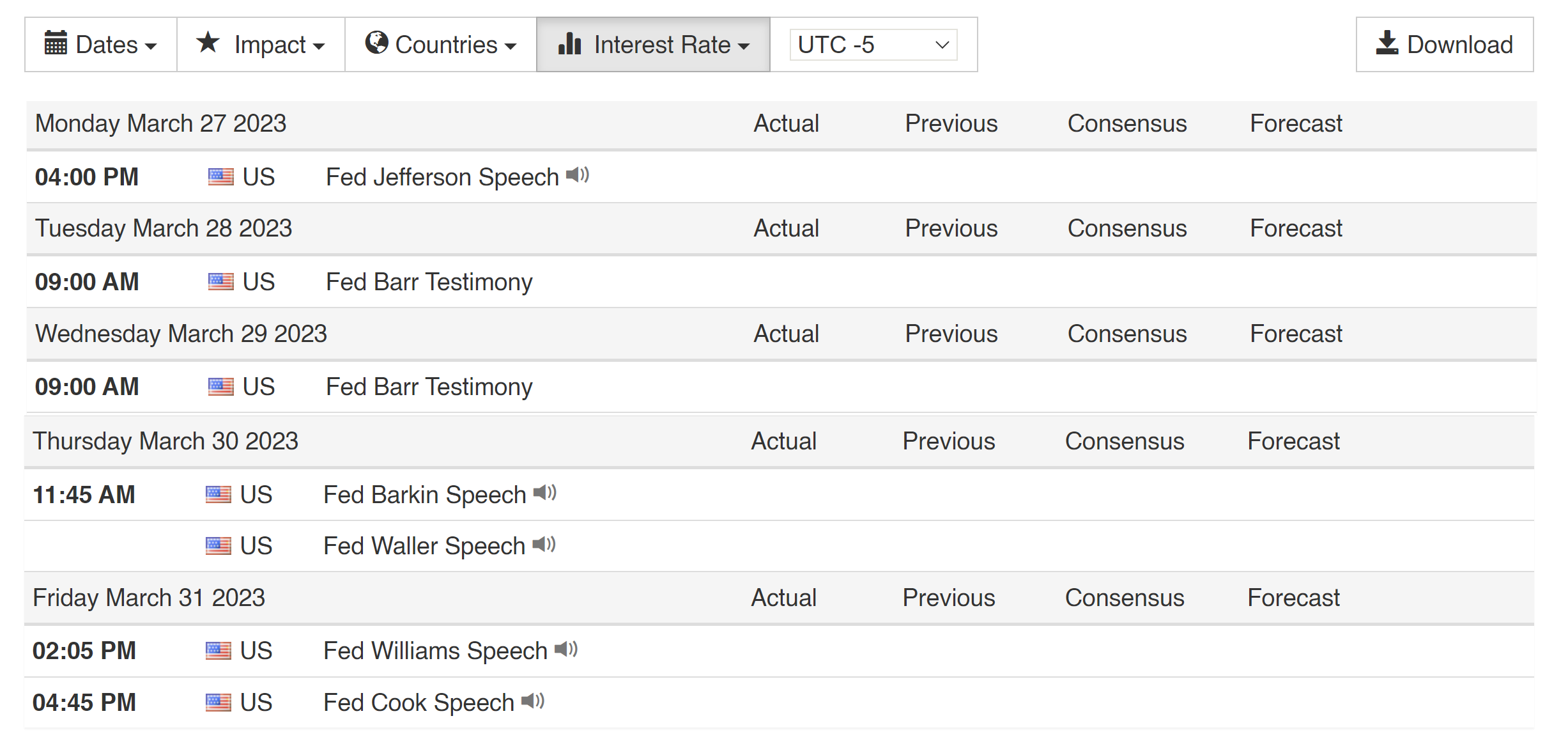

With this in mind, the numerous speeches by Fed officials this week could be interesting and should be watched by traders. Particular attention must be paid to the US Senate Banking Committee hearing on the Silicon Valley Bank collapse with FDIC’s Gruenberg, Vice Chairman for Supervision Michael S. Barr, and Treasury Department officials on Tuesday, March 28.

Economic Data That Could Move Bitcoin and Crypto

On Tuesday, March 28, the Conference Board (CB) will release the US Consumer Confidence numbers for March at 10:00 am EST. The reading came in at 102.9 in February, well below expectations of 108.5 and down for the second month in a row.

For the month of March, market experts expect a further decline to 101.0. If the forecast is exceeded, the US Dollar Index (DXY) is likely to continue its upward movement of the previous week and could act as a headwind for Bitcoin. An eventual decline of even greater magnitude, on the other hand, is likely to weaken the DXY and favor crypto.

On Thursday, March 30, 2023, the final US Gross Domestic Product (GDP) number for the fourth quarter in 2022 will be released at 8:30 am EST. Projections are for economic growth of 2.7%.

If the number is confirmed or even better, it could speak for the resilience of the US economy and alleviate concerns about a recession. The reaction in both traditional financial markets and the Bitcoin market is likely to be positive.

On Friday, March 31 at 8:30 EST, the Bureau of Economic Analysis will present the core PCE rate for the US for the month of February. This data point is expected to be the most important of the entire week, as it is the favored inflation gauge by Jerome Powell.

The forecast is for a month-over-month increase of +0.4%, the same as the previous month. Last month, the PCE price index had already exceeded market forecasts at +0.6%. As a result, there was a downward movement on the financial markets. However, if the core inflation rate has increased less, the Bitcoin price is likely to increase as a reaction.

At press time, the Bitcoin price was at $27,774.