The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Coinbase April Outflows

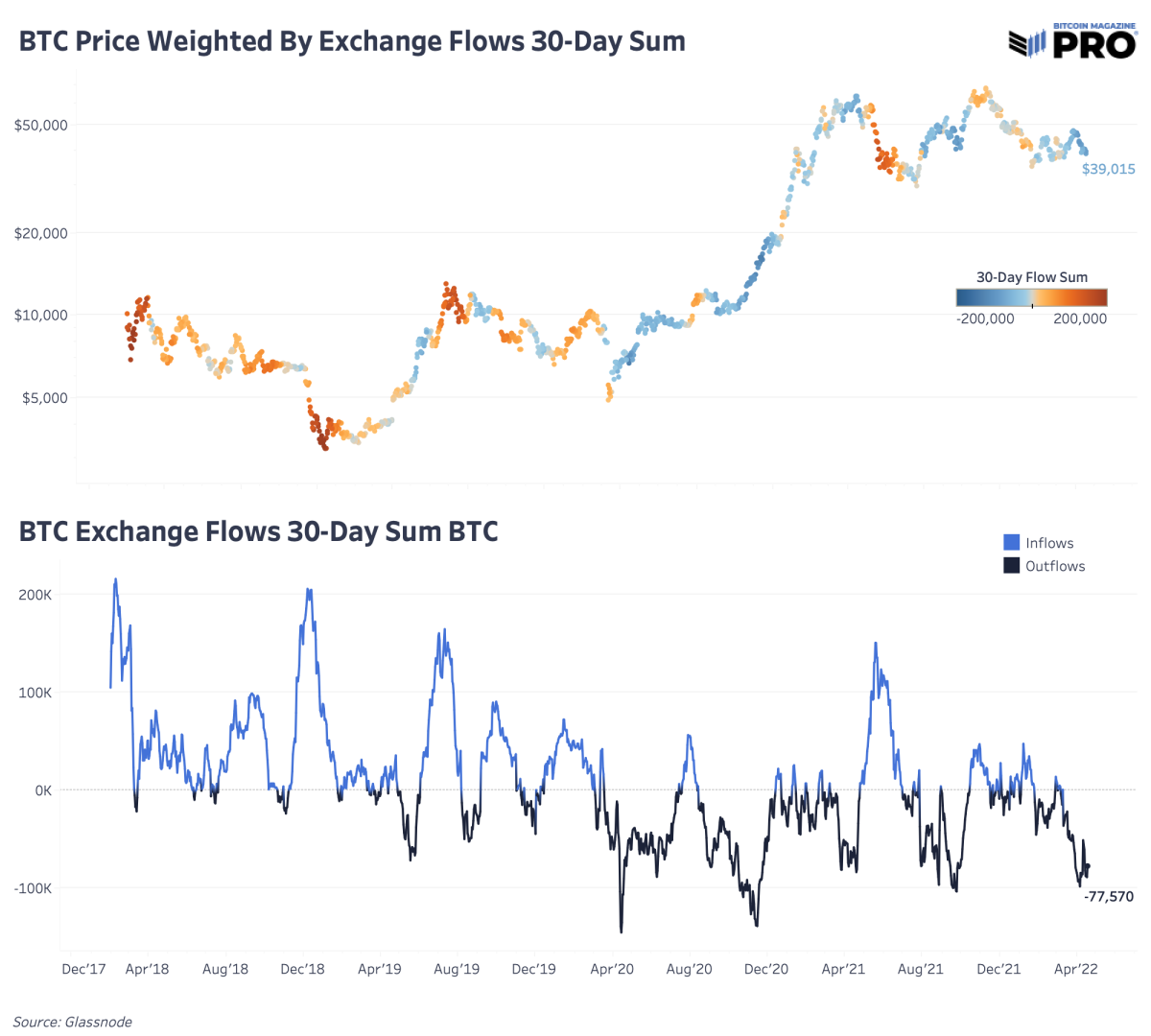

As we’ve highlighted in previous analyses, the latest bitcoin outflow from exchanges has been relentless over the last month despite a lack of price appreciation. With March 2022 being the second-highest outflow month in bitcoin’s history, April has followed up with similar outflow strength so far. In our view, exchange balance outflows is one of the better metrics available for assessing current demand and accumulation sentiment.

Over the last 30 days, nearly 80,000 bitcoin, worth over $3 billion, has left exchanges with the largest outflows coming from Coinbase. Previous major 30-day outflows at this level have corresponded to price appreciation but now we are in a much more unique market structure.

(Source)

30-day sum of bitcoin exchange flows (bottom) and flows weighted by price (top)

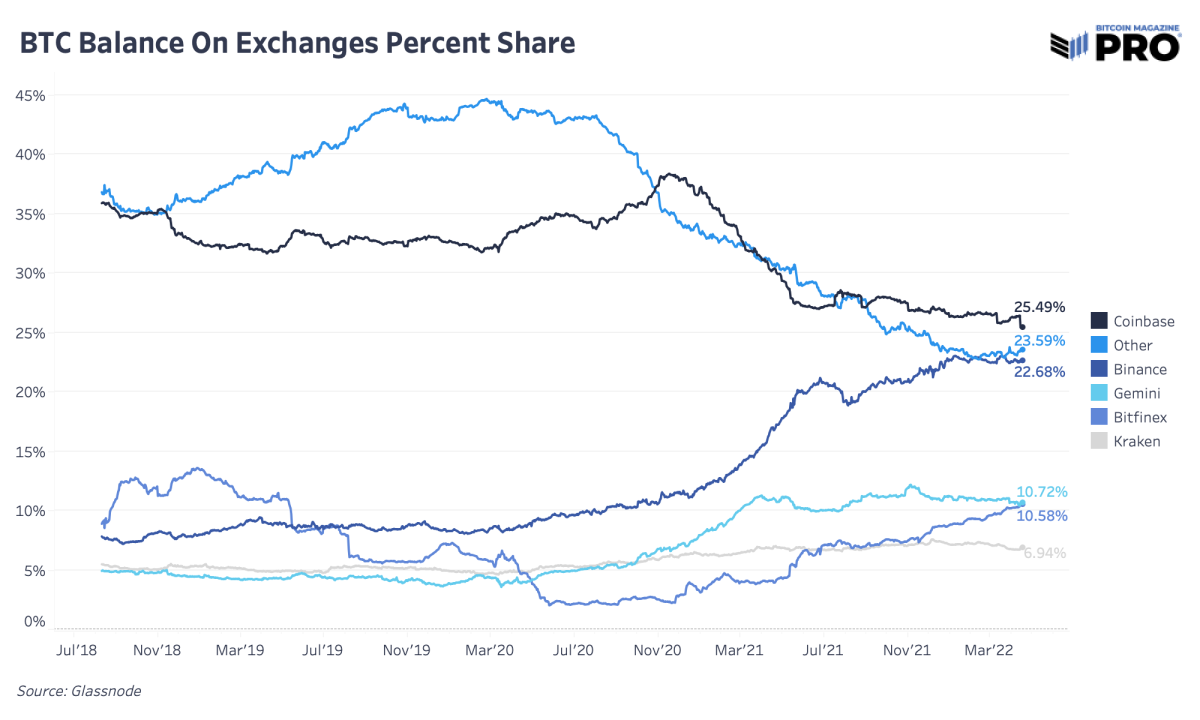

When we talk about exchange balances, the majority of the market can be explained by trends in Coinbase and Binance, with both exchanges having over 20% of total known bitcoin exchange balances on their platforms, respectively. Together, they make up 48% of known bitcoin on exchanges. We rely on Glassnode’s heuristics and data science techniques to determine known exchange addresses and balances.

Bitcoin balance on various exchanges based on percentage each exchange holds

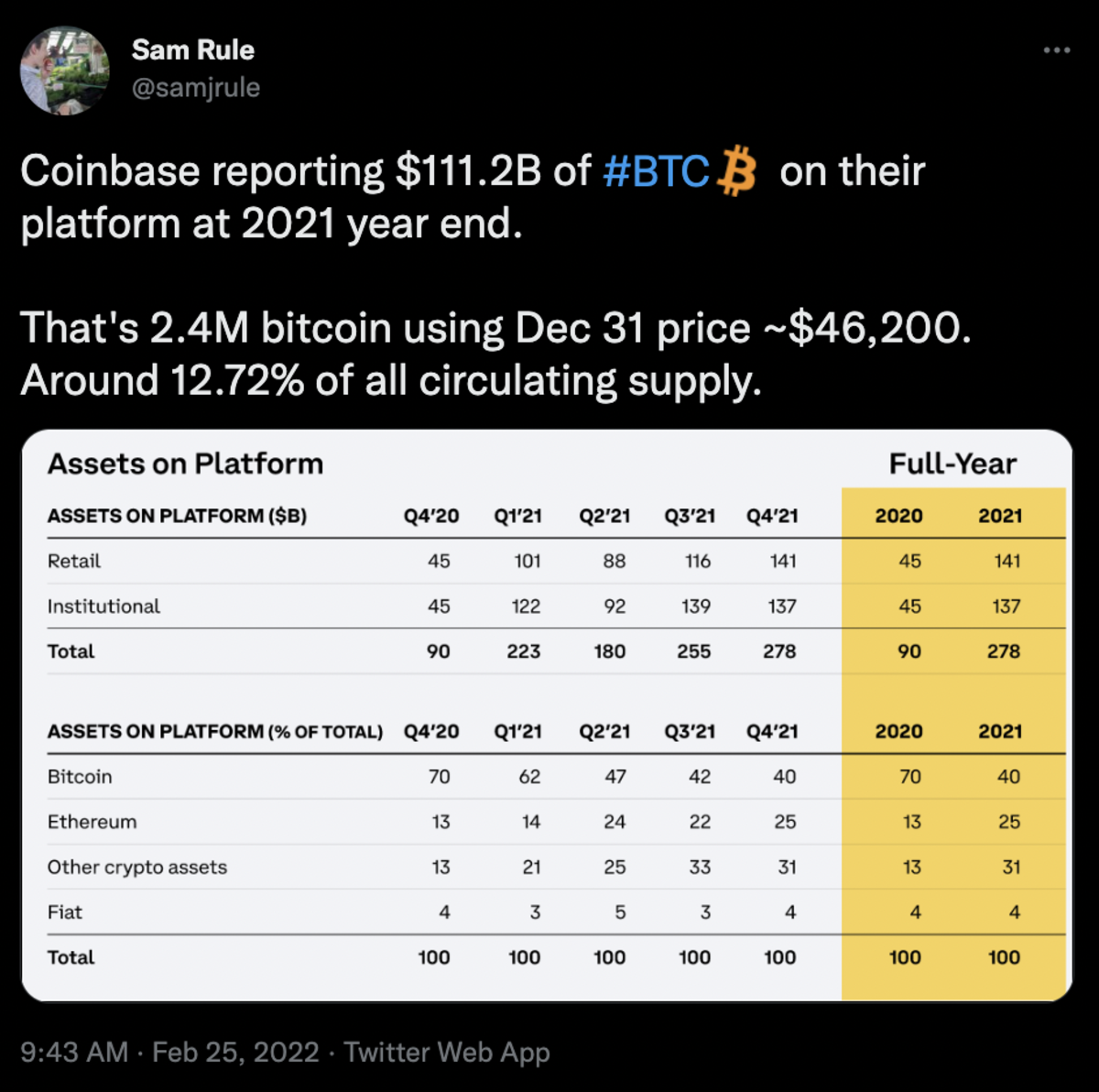

Coinbase reports a much higher number of bitcoin “assets on platform” as they also include the amount of bitcoin in their institutional custody services. At the end of last year, they reported over 2.4 million bitcoin on their platform.

(Source)

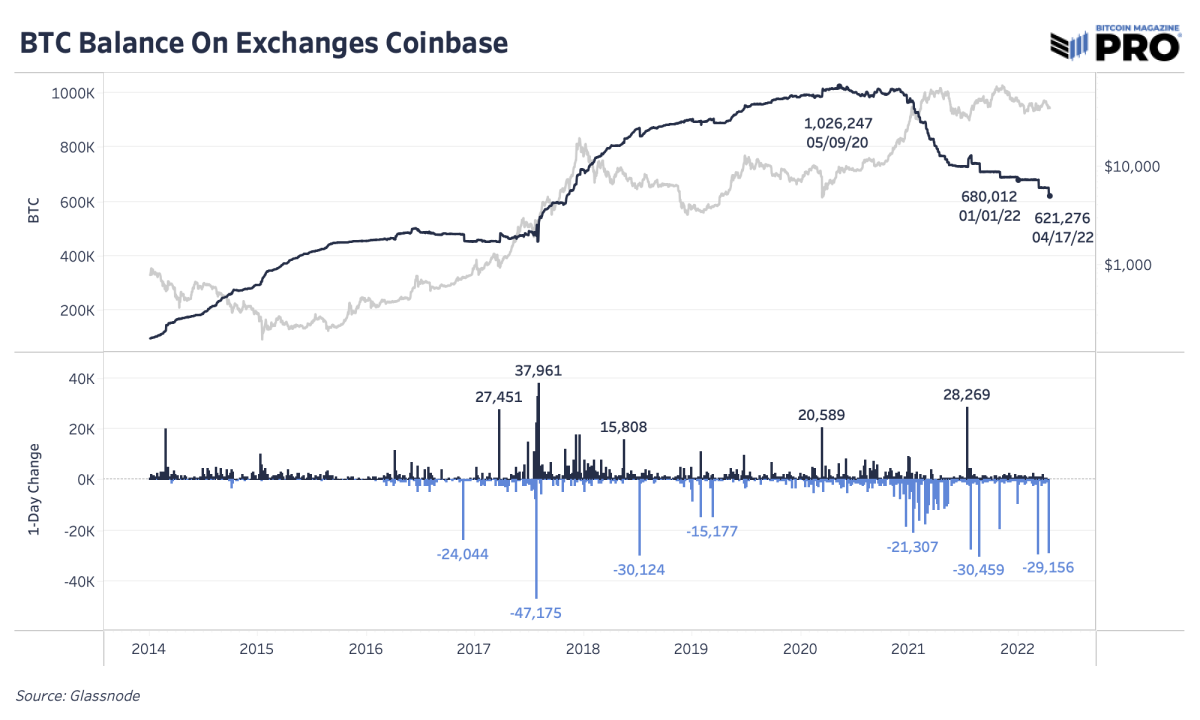

As for their exchange balances, the total bitcoin balance is down 8.63% year-to-date and down 39% since the peak in May 2020. We see this continued stair-step pattern over the last six months where large 10,000-plus chunks of bitcoin are being removed from the exchange at a time. Last Thursday was one of the largest one-day outflow days (in bitcoin-relative terms) over the last few years.

Bitcoin balance on Coinbase exchange