When it comes to talk of “The Bitcoin Bubble,” the FUD never stops — especially when it comes from traditional financial institutions like Morgan Stanley.

They Look the Same (But Not Really)

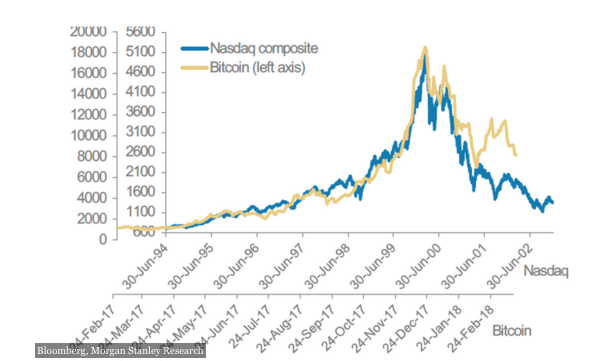

According to Sheena Shah, a strategist at Morgan Stanley, there are similarities between Bitcoin and the Nasdaq during the 1998-2000 technology bubble — with his argument centering around the fact that both experienced massive run-ups before dramatically decreasing in value.

As displayed in a chart from Bloomberg and Morgan Stanley Research, Nasdaq and Bitcoin appear to have followed very similar patterns. However, the timeframe in question is highly skewed — and apparently illustrates Morgan Stanley’s ignorance to the fact that Bitcoin has existed for nearly a decade.

On the graph in question, Nasdaq is charted from June 1994 until June 2002 — an 8-year span. It is then overlaid with a chart of Bitcoin over a significantly shorter timespan, from February 2017 to February 2018. Forbes then notes that “If Bitcoin follows the same pattern it could be around $1,500 in a few months time frame.”

Of course, simply adjusting the data to comparable timeframes would effectively eradicate the argument entirely, not to mention the fact that one could fairly easily explore Bitcoin’s history and find not entirely dissimilar peaks and valleys — suggesting that the so-called “Bitcoin Bubble” has burst many, many times.

Forbes also notes that Shah’s report “found some disturbing similarities,” including:

- The four trough to peaks for the Nasdaq averaged 40%

- The three trough to peaks for Bitcoin have averaged 43%

- The five peak to troughs for the Nasdaq averaged a decline of 44%

- The three peak to troughs for Bitcoin have averaged a decline of 47%

Once more, simply adjusting the data to comparable timeframes would render these statistics virtually pointless.

Shah is not the only one who believes Bitcoin is a bubble, of course. As noted by Forbes, Stefan Hofrichter, Head of Global Economics & Strategy at Allianz, has argued that Bitcoin has fit into some of his criteria for determining whether or not an asset is in a price bubble.

Others aren’t buying what the FUDsters are selling. Tom Lee, currently the Head of Research at Fundstrat and ex-J.P. Morgan Chief Equity Strategist, has claimed that Bitcoin is well oversold on his proprietary Bitcoin Misery Index. He also has bullishly stated that the dominant cryptocurrency by market capitalization could hit $91,000 by early 2020.

Do you think Bitcoin is a bubble? Do you think Morgan Stanley’s report is just misguided, or is it intentionally misleading? Let us know in the comments below!

Images courtesy of Shutterstock, Bloomberg/Morgan Stanley Research, CoinMarketCap.com, and Bitcoinist archives.