After reaching new depths below the 8k level near the end of September, market valuations in BTC/USD have been largely trendless. Over the last month, bitcoin has been caught in a narrowing price range that has made it difficult for quantitative traders to plot the next trend direction for the crypto pair. Can price correlations between BTC and the GBTC offer some predictive value? One analyst says this is unlikely.

Recent Price Declines

On September 24th, major selling pressure in BTC/USD sent valuations to new lows at $7,988. For bitcoin bulls, this move marked an ominous break of key psychological support levels and the effect it’s had on sentiment has left markets essentially directionless.

However, historical trends suggest that these types of downside corrections can often work as a precursor to the development of price rallies and quant traders seem to be looking for external correlations as a way to verify the validity of possible upside projections in the BTC/USD valuation.

GBTC Correlations

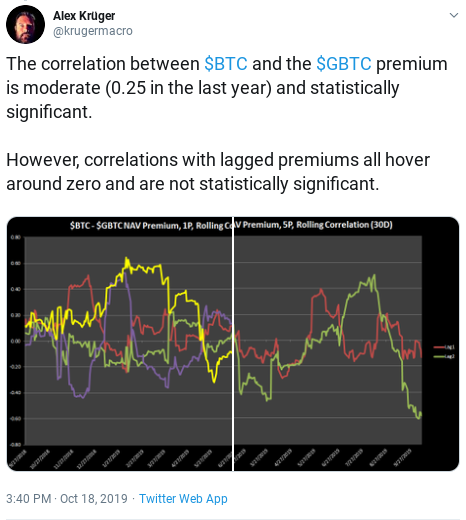

However, one analyst suggests that expected price correlations between bitcoin price and the $GBTC premium carry little predictive value and that correlation with lagged premiums is likely to fail traders that use the data to project future price moves in the BTC/USD valuation. As macro analyst Alex Kruger (@krugermacro) explains:

Traditionally, financial correlations are designed to measure relationships between at least two market variables over a certain period of time.

For instance, if the historical market relationship between two assets is inversely correlated, traders might begin to buy one asset while the price of the other measured asset begins to decline. When financial correlations are strong, their relationships can carry substantial predictive value when structuring future positions in the market.

BTC Leading Indicators

However, as Kruger goes on to explain, a $GBTC premium relative to net asset value (NAV) is not a leading indicator for BTC/USD. Rather, it’s simply a reflection of current conditions in the market:

Predicting the value of bitcoin-based on $GBTC premiums widening/narrowing has no value. Again, one may as well be analyzing how weather affects $BTC… The tail does not wag the dog.

Given all of the recent speculation about the possibility of a new bitcoin ETF, it’s likely that many crypto traders have been viewing trends in the $GBTC premium as a way to gauge potential price moves in BTC/USD. However, the SEC’s disapproval of the Bitwise ETF has accompanied substantial price declines in bitcoin’s valuation, so it may not be surprising to see trader expectations for these types of correlations continue to break down in the future.

What’s your view on GBTC’s predictive effects on bitcoin valuations? Let us know your thoughts in the comments below!

Images via Bitcoinist Media Library, Twitter: @krugermacro