Today, Bitcoin celebrated an epic milestone with the mining of Block 800,000, marking a momentous occasion in the first cryptocurrency’s history. James Check aka Checkmate, lead on-chain analyst at Glassnode, took to Twitter to share some intriguing insights into the Bitcoin network’s progress up until this point.

In a series of tweets, Checkmate delved into various aspects of Bitcoin’s journey, painting a fascinating picture of Bitcoin’s growth and achievements. According to Checkmate’s analysis, a total of 19.437 million BTC have been created until block 800,000, with miners receiving 268.700 BTC in fees. The all-time miner revenue stands at an astounding $52.593 billion, with the majority coming from block subsidies (94.5%) and a smaller portion from fees (5.5%).

From Bitcoin Genesis To Block 800,000

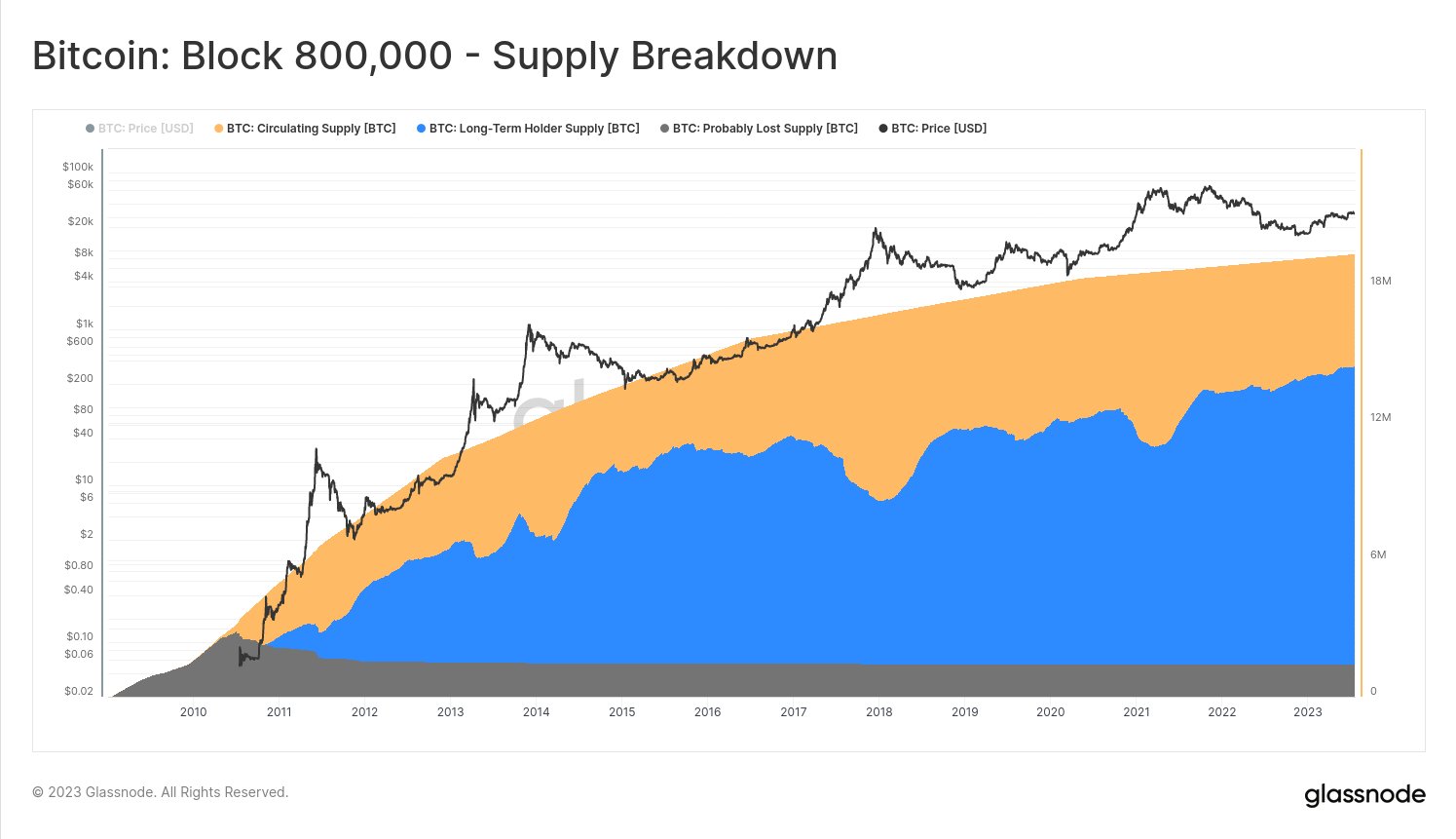

The longevity of Bitcoin’s blockchain allows for some interesting observations. Out of the 19.4 million BTC mined, approximately 7.5% have not been spent since the first exchange-traded price in July 2010, suggesting that these coins might be lost forever by early miners.

Furthermore, a substantial 74.6% of BTC is held off exchanges by long-term holders, highlighting a significant commitment to BTC by a substantial portion of its user base. Only 2.68 million BTC are held by short-term holders and 2.25 million BTC are located on exchanges.

A critical metric that Checkmate brings to light is the Unspent Transaction Outputs (UTXOs). Currently, the Bitcoin UTXO set contains 163.6 million UTXOs, out of which 2.275 billion have been spent and destroyed.

As UTXOs are created and destroyed, BTC volume is transferred, leading to an impressive 8.378 billion BTC being transferred over 800,000 blocks. This averages to about 10,473 BTC spent per block, resulting in a staggering $109 trillion in value settled on the Bitcoin network (or $137 million per block on average, when priced in USD).

The concept of “Coindays” has also been put under the microscope by Checkmate and provides valuable insights into BTC holding behavior. Coindays represent the accumulation of holding time for each unit of BTC. When BTC is spent, Coindays are destroyed. Checkmate points out that out of 70.2 billion Coindays created, approximately 37.8 billion Coindays have been destroyed (Liveliness = 0.538), indicating the extent of BTC’s movement and spending.

On another note, Joe Consorti, a market analyst at the Bitcoin Layer, offered his thoughts on the milestone. Consorti remarked that with block 800,00 being mined, the fourth halving of BTC supply is only 40,000 blocks away (~9 months).

The halving process is a defining characteristic of Bitcoin’s monetary policy, where its issuance rate is automatically reduced by around 50% at predetermined intervals, eventually leading to a fixed supply. Consorti added, “Absolute scarcity in a monetary order whose stated endgame is financial repression through inflating away its debt burden. You may want to look into it.”

Indeed, the achievements of Bitcoin over the past 14.5 years are nothing short of remarkable. With 867 million transactions confirmed at an average of 1,084 transactions per block, and all of this data fitting into a compact 497 GB blockchain, BTC has proven its resilience and value as the pioneering cryptocurrency.

At press time, the BTC price stood $29,844.