On-chain data shows Bitcoin hashrate has dropped more than 20% in the last 24 hours, a sign that could prove to be bearish for the crypto.

Bitcoin Hashrate Declines Over 20% In The Past Day

As pointed out by a CryptoQuant post, the BTC mining hashrate has severely dropped in the past 24 hours. Such a trend has usually been bearish for the price of the coin.

The “mining hashrate” is an indicator that shows the total amount of computing power connected to the Bitcoin blockchain network.

Validating nodes on the BTC network, called “miners,” require high amount of computing power in order to compete with each other to decide who gets to handle the next transaction.

Because of this, a high value of the Bitcoin hashrate can result in fast and efficient network performance. Also, high hashrate values usually also imply that there are a high number of nodes connected to the network. This leads to better decentralization of the network, and hence better overall security.

On the other hand, a low value of the hashrate may result in bad performance of the network. Its security would be lower as well due to being more centralized.

Related Reading | deVere CEO: Bitcoin Panic-Sellers Are A Christmas Gift To The Rich

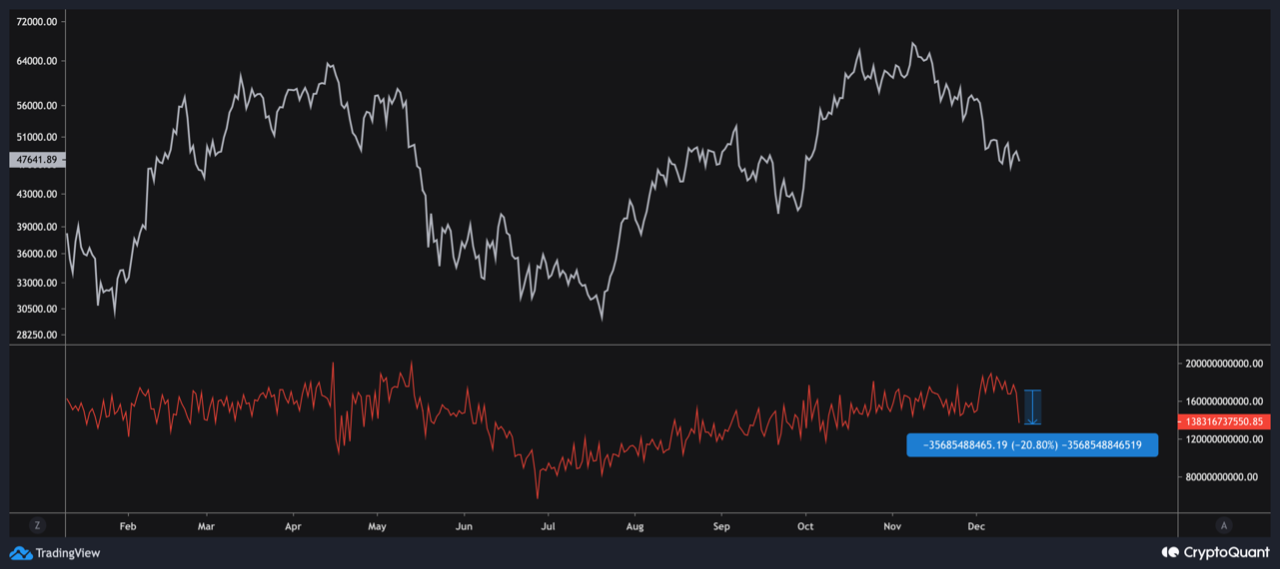

Now, here is a chart that shows the trend in the value of this Bitcoin hashrate over the past year:

Looks like the value of the indicator has sharply dropped today | Source: CryptoQuant

As you can see in the above graph, the Bitcoin hashrate has dropped around 20% in value in the past 24 hours alone.

This decline in the hashrate comes not long after the indicator completely recovered from China’s mining crackdowns and set a new all-time high.

Historically, high hashrate values have been associated with bullish trends since such values imply it’s profitable to mine on the Bitcoin network at the moment, and more miners get attracted to it.

So, a decline such as the one now would mean it is no longer feasible for some miners to run their facilities, and therefore they have opted to shutdown their operations.

Related Reading | The Debate Over Toxic Bitcoin Maximalism Rages On. Both Arguments After The Jump

Bitcoin miners going offline to this degree so rapidly may turn out to be bearish for the cryptocurrency’s price in the long term.

BTC Price

At the time of writing, Bitcoin’s price floats around $46k, down 6% in the last seven days. Over the past month, the coin has stacked 22% in losses.

The below chart shows the trend in the price of BTC over the last five days.

The price of BTC seems to have plunged down in the past twenty-four hours | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com