Investing In Hope

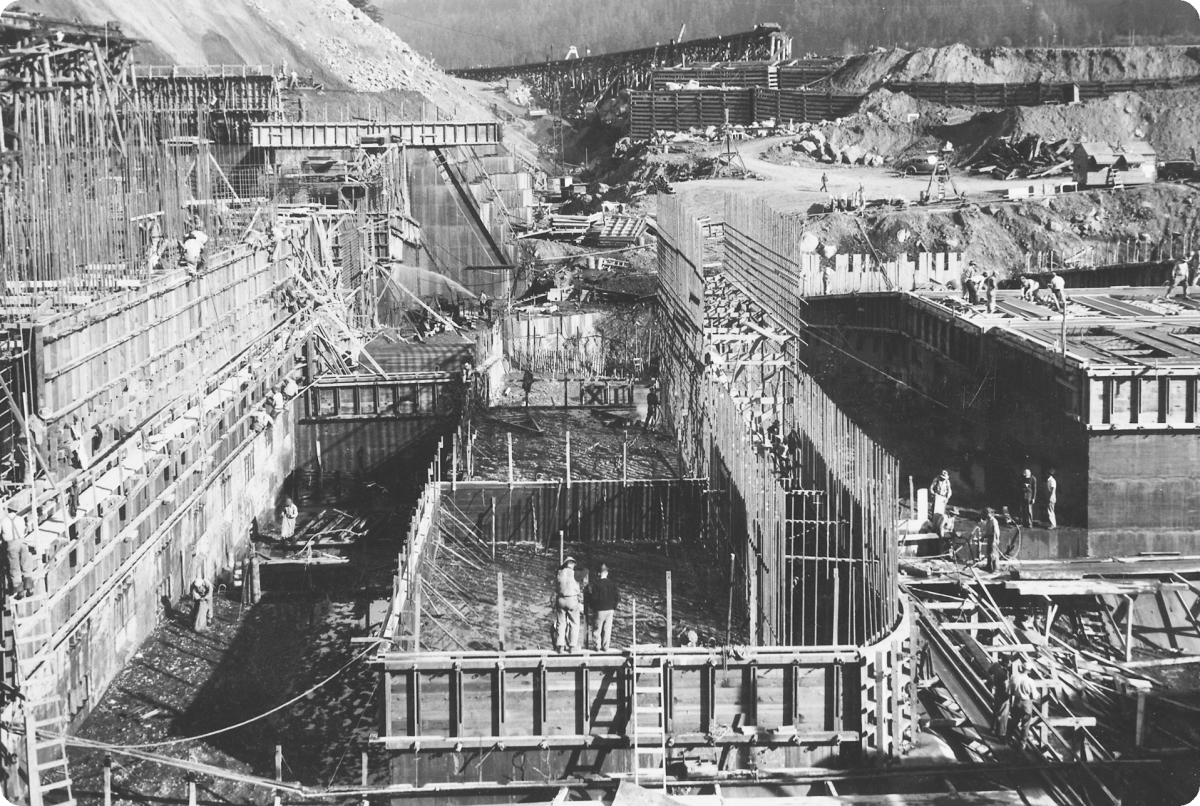

You know the New Deal -- a massive and unprecedented effort the United States federal government undertook in the 1930s to invest in infrastructure, build hope, and turn the course of a nation towards prosperity and justice. You’ve likely heard of the Green New Deal too -- all that infrastructure business, but with a sustainable twist.

We propose an Orange New Deal.

Bitcoin is hope. And it can be an engine of prosperity and justice. But to do that work, it needs infrastructure. Not roads or power lines, but Lightning Network nodes and channels, education, wallets, and sustainable mining.

The time to build Bitcoin infrastructure is now. But who is to build? Recent events in El Salvador suggest a surprising answer: governments.

Many bitcoiners are libertarians, or even anarcho-capitalists. These tend to think that governments should be small, weak, or not exist at all. They don’t care for the New Deal. If you’re of that mind, you likely won’t agree with what we suggest here and should instead pass this essay on to your big government friends. But if you take a more capacious view about the proper role of the state, if your ambitions are somewhat more pragmatic than those of the libertarian dreamers, and if you rather like the New Deal or the Green New Deal, we hope to uncover a case for an intriguing thesis: national and local governments should invest in Bitcoin infrastructure.

The idea is simple. Bitcoin — like clean water, good roads, or a solid power grid — is for anyone. But for it to truly make good on this inclusive promise, it needs infrastructure. Governments can help accelerate construction of that infrastructure, and so create new opportunities for prosperity and financial inclusion.

Our argument has two steps: governments should invest in public goods, and Bitcoin is one such good.

Governments Should Invest In Public Goods

Focus on the idea of a public good, which has three parts: good, non-rivalrous, and non-excludable. Public goods are good; using them brings some benefit. Your use of a non-rivalrous good doesn’t reduce its usefulness to someone else; you can enjoy the wide, violin-like vibrato as heard in an Yngwie J. Malmsteen concert, for example, without diminishing the enjoyment of the metalhead next to you. A good is non-excludable to the extent that it is very costly to prevent non-paying consumers from accessing it. A flourishing mangrove forest has all sorts of benefits for nearby ecosystems, and it’d be hard to prevent those benefits from accruing, for example, to local fisheries.

Why should governments invest in public goods? Many point here to coordination problems. Clean air, for example, is good for everyone, and its benefits spill over even to those who didn’t pay for that clean air. But who will pay for it? What’s needed here is coordination; we all know this thing will benefit everyone, but the marginal benefits to individuals may be too small to motivate them to act on their own. Or perhaps they’d act, but not as much as one might like. The coercive might of the state can coordinate for optimal behavior, goes one standard argument, so governments invest in clean air. So also for a literate citizenry, or healthy networks of roads and power lines. Governments are supposed to wield their power to coordinate toward goods that would otherwise go underdeveloped.

The Bitcoin Network Is A Public Good

It’s useful to distinguish Bitcoin the network (capital “B”) from bitcoin (lowercase “b”), its native asset. We do not claim that bitcoin is a public good; it isn’t. When you have some bitcoin you diminish the use others might have from that quantity of bitcoin — Michael Saylor, for example. And you can easily keep others from capturing those benefits themselves; just keep your private keys private.

Bitcoin the network, by contrast, is a public good.

The Bitcoin network is good. Bitcoin the network is an open, censorship-resistant, inflation-resistant monetary network for all of humanity that cannot be controlled by any despot or corporate machine. It hosts, furthermore, a digital bearer asset that is readily auditable by anyone with an internet connection, and that offers remarkable settlement assurances. Detractors will disagree, of course -- that is their business model -- but we think that Bitcoin is net good for humanity.

Bitcoin is non-rivalrous. Our accessing the network — accepting payment in bitcoin, running a node, and so on — doesn’t diminish your access. Indeed, Bitcoin is anti-rivalrous. As with other network goods, its value increases the more people access it. The more people that speak Spanish, the more valuable it is to know that language yourself. As more people offer or accept bitcoin payments, its network grows in usefulness too.

There is a wrinkle here — blockspace is rivalrous and excludable. Not everyone can squeeze their transactions on-chain, and those who pay higher fees get priority. Luckily, though, this wrinkle is ironed out by Bitcoin’s Layer 2 manifestations (like the Lightning Network) that make it possible to transact with Bitcoin with minimal use of precious blockspace.

As for non-excludability, it is here that Bitcoin shines most of all. It is very cheap to access the network; a smartphone will do. And it is very expensive for anyone to stop you from doing so. States have tried, mostly without success. The software that keeps the machine running is free and open-source; anyone can take a look under its hood, make modifications or upgrades, and build new applications atop the network’s fundamental layer.

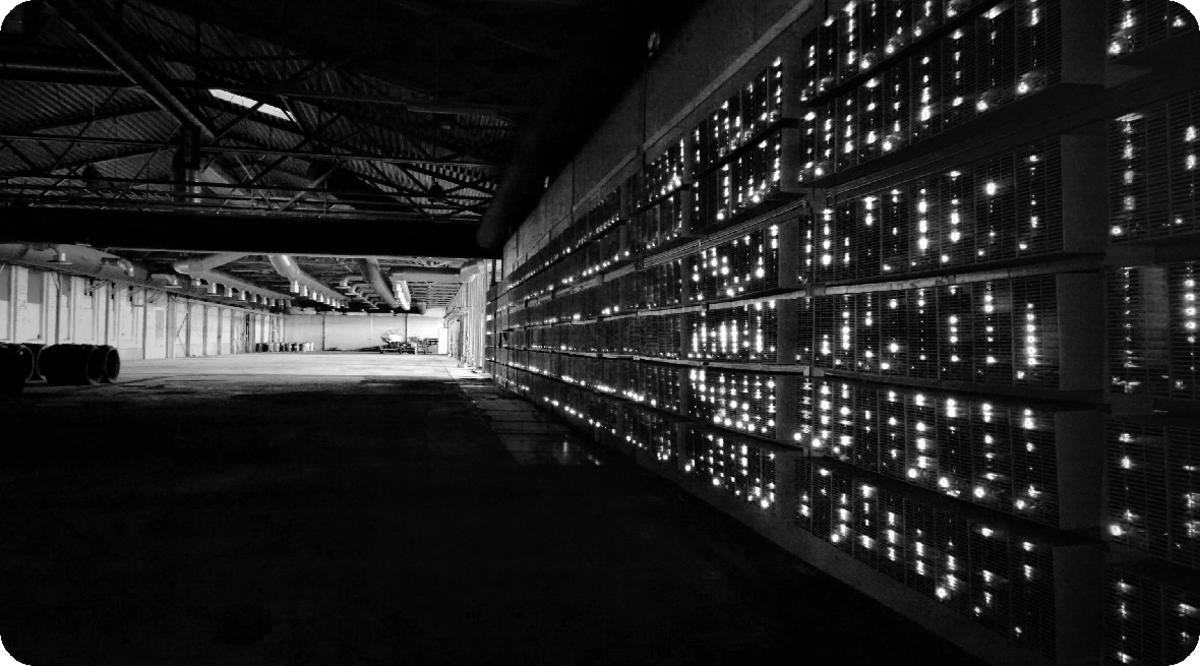

What makes this all possible, is, in a word, infrastructure: public Lightning Network nodes, a healthy swarm of full Bitcoin nodes validating new blocks, miners that gather transactions into blocks and secure the network, educators who show us all how to navigate the space safely, hardware wallet manufacturers who enable secure transaction signing, and Bitcoin Core developers who maintain the network’s main open source software. The most obvious way to promote the public good that is the Bitcoin network is to invest in infrastructure along these lines.

We could trust private actors to invest. But we might also want governments to contribute too, to accelerate access to Bitcoin, to provide healthy competition, and to coordinate towards optimal outcomes.

Let’s Get Building

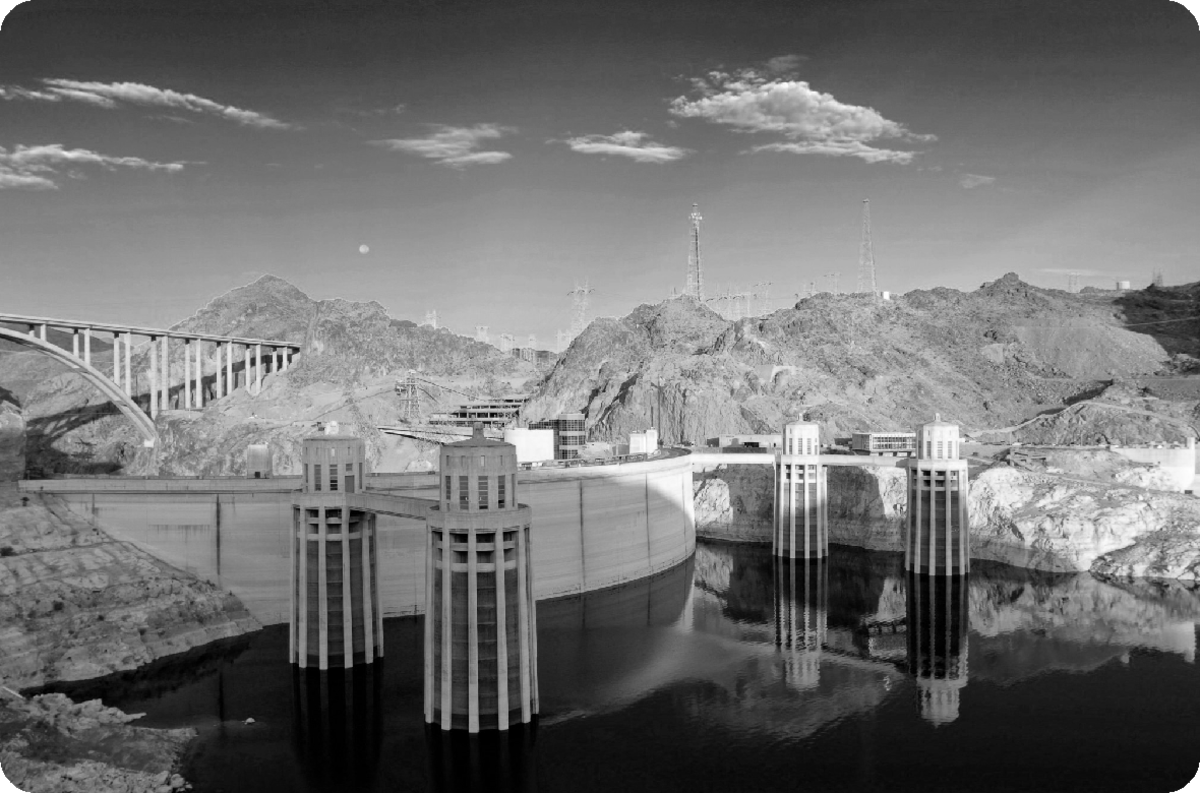

With those two steps in place, the conclusion follows: governments should invest in Bitcoin infrastructure. Let’s make that proposal more concrete. What could governments actually do here? We know the New Deal: public works, roads, hospitals, airports, dams, and sweeping regulatory changes. What could an Orange New Deal look like?

A mighty host of building opportunities here await funding. For example:

- Internet access: open WiFi networks, satellite access for remote regions, subsidized mobile data plans for those that need them.

- Lightning Network nodes: lots of in-bound and out-bound liquidity, and with a steady network presence and low routing fees.

- Developer support: Sponsor developers or projects with grants, and so promote innovation and better user experience across wallets, nodes, mining pools, and protocols built atop Bitcoin’s main layer.

- Education: training in self-custody, spending and receiving bitcoin, paying employees in bitcoin.

- Translation: bringing educational materials into every major language.

- Accessibility: adapting Bitcoin educational materials, wallets, and hardware for use by members of, e.g., the Deaf or Blind communities.

- Community wallets: These occupy the middle ground between full self-custody and fully centralized custody — think here of the Bitcoin Beach ecosystem.

- Sustainable mining: new dams, wind farms, solar farms, and geothermal mining operations to keep the network secure in an environmentally friendly way.

- Fair and consistent tax and accounting rules: National and local regulators have opportunities to coordinate here and thus save bitcoin users (aka citizens) from a host of headaches and pitfalls.

- Direct bitcoin payments: Cash payments in a depreciating sovereign currency work well when immediate consumption is the goal. But for redistribution with a longer time horizon in mind (reparations, for example), governments should give away the ultimate anti-inflation asset: bitcoin. This needn’t involve new taxation or debt; many governments already have significant bitcoin holdings seized from criminals. Every payment of this kind would strengthen Bitcoin’s already formidable network effects, and stimulate further interest in the network.

Some of these tasks are more apt for national or state and provincial governments; others work better at the municipal level. Each will contribute to the Bitcoin network and its liberating use — not just for citizens, but for people across the globe.

Objections Answered

The New Deal was not without controversy. An Orange New Deal would inevitably find detractors also. The objections would come from two sides: Bitcoin skeptics, and Bitcoin advocates.

Bitcoin skeptics claim that Bitcoin struggles to scale, is available mostly for the educated and wealthy, or causes environmental harm. But note: the investments described above would cut against each one of these objections. Lightning Network infrastructure helps Bitcoin scale. Education and development expand access to the network. And investments in sustainable mining operations drive hydrocarbon-burning miners out of business. The investments we advocate, in short, don’t just make Bitcoin’s benefits more widely available; they also make Bitcoin better on balance. The argument of this essay supports measures that would help alleviate the very problems the skeptics raise.

Some of Bitcoin’s most ardent advocates will object that state sponsorship of Bitcoin infrastructure isn’t very cypherpunk. If states get involved, the story goes, they’ll mess up the network by attempting to censor transactions or extract rent. We reply: the Bitcoin network is already large and robust. And the software on which it runs is free and open-source. Any extra gadgets that connect to the network empower their users to access something that is itself beyond the control of any state or corporate despot. Note, too, that governments already invest in their own proprietary monetary networks and routinely censor transactions. Direction of any of those resources towards Bitcoin is net positive for the world. It’s better to achieve marginal gains in the real world than to pursue ideological purity.

Fans of nascent Central Bank Digital Currency schemes will ask why governments shouldn’t invest in their development instead. There are a few reasons. First, CBDCs inherit many of the problems of fiat currencies — their supply can be capriciously inflated, which makes them poor stores of value, and they lack the privacy and censorship-resistance of Bitcoin. Second, this will take some time, whereas Bitcoin already exists. Governments could invest in Bitcoin infrastructure now even as they plan for CBDCs. Finally, Bitcoin is for everyone. To build Bitcoin is to grow a network that benefits the whole world; it is to invest in humanity rather than just in the citizenry of one nation with access to some local monetary regime. Diehard nationalists who wish to benefit just a select group of people — their compatriots — won’t see much sense in this. But others will see the wisdom in benefitting all, we think. And Bitcoin does that.

We said up top that this wasn’t an article for libertarians. But some will still be reading, and they will object that governments are less efficient than other agents when it comes to the hard work of building. We reply: perhaps so. We encourage those of this mind to start investing, whether for charity or for profit, in Bitcoin developers, sustainable mining operations, educators, and so on. Prove -- now, please -- that voluntary efforts are superior to state-sponsored ones.

El Salvador is leading the way. It is time for other nations to follow and for each to launch their own Orange New Deal.

Let’s get building.

About the Authors: Andrew M. Bailey (@resistancemoney) teaches at Yale-NUS College; Bradley Rettler (@rettlerb) teaches at the University of Wyoming. Both work with the Resistance Money Bitcoin research collective. All images are from Wikimedia Commons: 1, 2, 3, 4, 5.

This is a guest post by Andrew Bailey and Bradley Rettler. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.