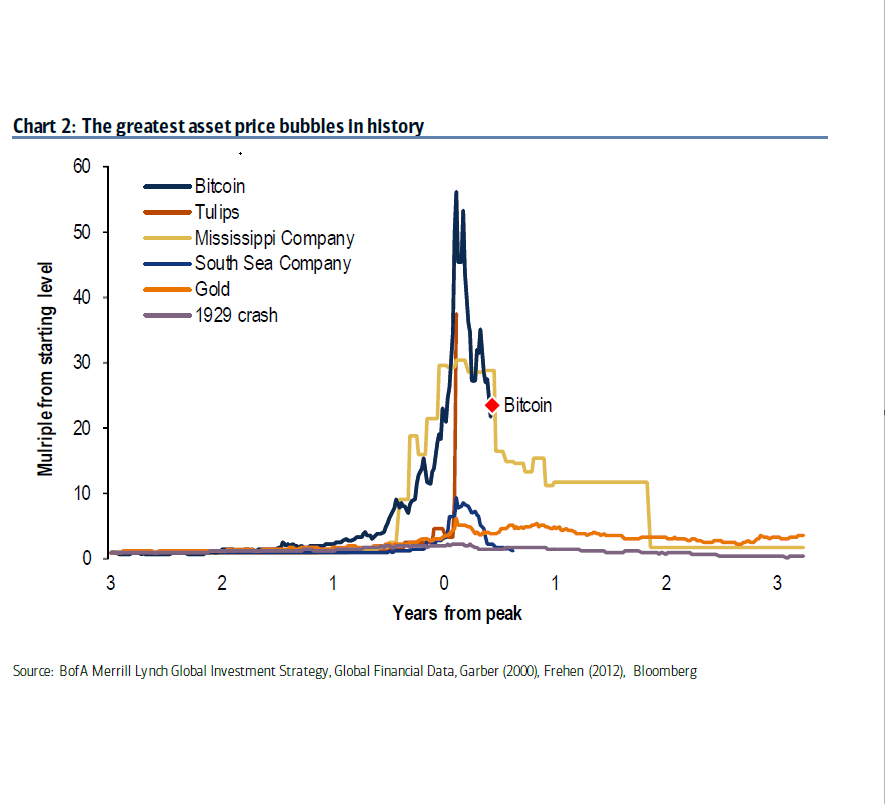

Ignoring pretty much every piece of information outside of Bitcoin’s chart, Bank of America has officially announced that the greatest bubble in history is popping, but for real this time.

The Greatest Bubble in History

For at least the 279th time, Bitcoin is dead.

As noted by Bloomberg, Bank of America’s Chief Investment Strategist Michael Harnett made the claim that the gold standard of cryptocurrency’s bubble has popped in a Sunday note. “The cryptocurrency is tracking the downfalls of the other massive asset-price bubbles in history less than one year out from its record,” claims the media company’s report.

Additional explanations from the North Carolina-based multinational financial services company, however, are not provided.

Conveniently Ignoring the Facts

Bank of America’s FUD (Fear, Uncertainty, and Doubt) comes at a time when Bitcoin is struggling to maintain price action above $7000. It also, conveniently, fails to take into account the dominant cryptocurrency by market capitalization’s past parabolic runs and subsequent falls, which illustrate that the current situation is — more or less — par for the course.

Bank of America also apparently glosses over the cryptocurrency’s major developments, including the exciting Lightning Network — a second layer payment protocol which enables instant transactions between participating nodes and solves the scalability problem plaguing Bitcoin’s recent history.

Furthermore, Bank of America seems to care less about the increased interest in Bitcoin trading from ultra-rich insitutional investors like George Soros and the Rockefeller family — both of which have officially signaled their intentions to trade cryptocurrency.

The bank also fails to mention the New York Stock Exchange’s interest in listing Bitcoin futures contracts and the SEC’s potential allowance of Bitcoin ETFs (Exchange Traded Funds) — both of which signal increased legitimacy.

America’s second largest bank has, however, expressed its fear of Bitcoin in the past. In February, Bank of America wrote in a Securities and Exchange Commission report:

The widespread adoption of new technologies, including internet services, cryptocurrencies and payment systems, could require substantial expenditures to modify or adapt our existing products and services.

The major bank has also contributed to the alleged popping of the Bitcoin bubble, having banned credit card purchases in the beginning of February — conveniently when the cryptocurrency market had just started to really roll downhill.

How much credence do you give Bank of America’s FUD-filled statements? Do you think Bitcoin is a bubble? Let us know in the comments below!

Images courtesy of Bloomberg, Reuters, and Bitcoinist archives.