This year has undoubtedly been one of the most bullish years on record for cryptocurrencies.

Bitcoin (BTC), Ethereum (ETH) and numerous other large cap cryptocurrencies achieved their all-time highest values amidst rising institutional interest from the likes of PayPal, Tesla, and BNY Mellon. This has sent the market into a buying frenzy, as savvy investors look to spot the most undervalued crypto assets before they begin exploding in value.

When it comes to assessing the potential value of a project, one simple metric stands out above all else — market capitalization. Early-stage projects with significant potential but a relatively low market capitalization represent the most potentially lucrative opportunities, since they have the potential to achieve considerable growth.

But it takes a discerning eye to separate the hype jobs from the projects with genuine prospects. Here, we take a look at three projects we think have the fundamentals, community, and products necessary to explode in the near future.

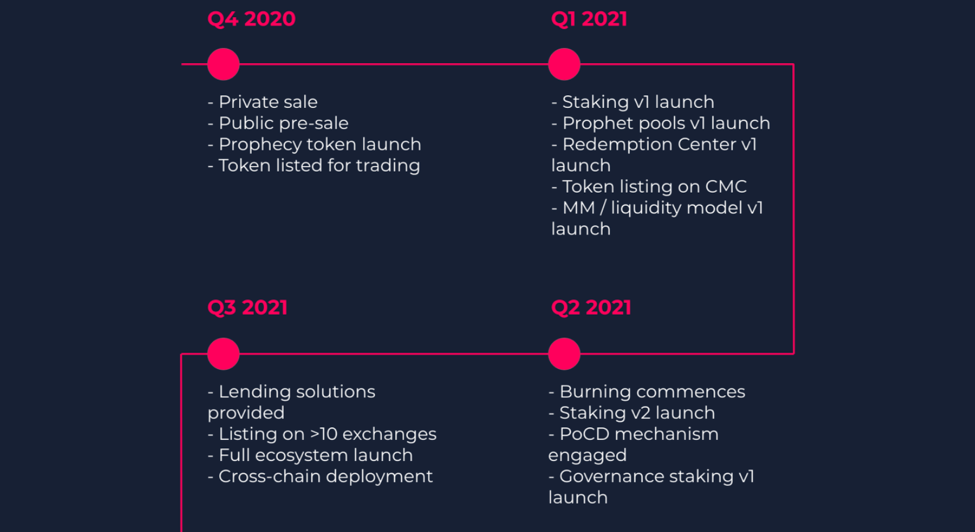

Prophecy ($PRY)

Prophecy is an interesting one. Like Bitcoin, it’s built to provide an entirely new financial ecosystem that resolves some of the biggest gripes with traditional money. It’s also created by an ethical anonymous team, that puts its community at the forefront while operating in the background to build a suite of Defi financial products that empower its users.

Unlike many other blockchain protocols which are typically just a copy and paste of something else — with a few extra features slapped on top. Prophecy is an entirely original platform built around a novel consensus mechanism known as Proof-of-Committed Decay (or PoCD) — which essentially stimulates the Prophecy economy to remain as liquid as possible while ensuring that the supply of PRY tokens is closely balanced to demand to prevent loss of purchasing power.

But here’s where it gets even more interesting. Prophecy isn’t just providing a sound monetary unit in the PRY token, or a next-generation economic protocol, it’s also building an entire range of products that leverage this technology to provide a range of use-cases to PRY holders. The first of these is going live very soon — ‘Prophet Pools’ — which essentially yield pools that accelerate the earning process to a matter of hours or days.

In total, the team behind Prophecy plans to release more than eight different financial solutions in the next year alone — indicating big things may be in store for this project. And with a tiny market capitalization of just under $2 million, its strong fundamentals and the rapid pace of development make it one worth watching.

EasyFi ($EASY)

If you’ve been involved in the cryptocurrency space to any major capacity in the last year or so, then you’re likely aware that decentralized lending and borrowing platforms are extraordinarily popular.

They’re frequently used by DeFi traders looking to leverage their long-term positions and borrowers aiming to extract liquidity from their assets. On top of this, lenders can use them to earn a safe return on their assets.

But these open lending platforms have been largely limited by two major problems: they generally couldn’t facilitate undercollateralized loans and frequently suffer from the high gas costs on the Ethereum blockchain. That is, until now.

The modern decentralized lending platform EasyFi resolves both of these challenges by leveraging Polygon’s (formerly Matic Network’s) layer 2 technology to reduce transaction fees to a bare minimum while enabling borrowers to take out undercollateralized loans thanks to its TrustScore integration.

Wake up World….to the power of #Polygon

Many congratulations to our ecosystem & tech partner #Polygon (formerly @maticnetwork)

Super excited for our friends at #Matic on their pivot to become #Ethereum’s Internet of #Blockchains – the next chapter in scaling #ETH!

— @easyfi.network (@EasyfiNetwork) February 10, 2021

It also incorporates a novel incentive mechanism, which sees users rewarded with EASY tokens for using the platform. These EASY tokens can then be staked to earn MATIC tokens, giving users two levels of rewards just for taking out or providing low-interest loans.

With a small market cap of around $24 million, EasyFi is just a fraction of the size of larger, but arguably weaker solutions. And with transaction fees now becoming a major burden to a huge proportion of cryptocurrency users, it wouldn’t be surprising if it sees a massive influx of users in the near future — potentially driving its market capitalization up considerably as a result.

RAMP ($RAMP)

RAMP is a new DeFi platform that aims to produce cross-chain liquidity on/off-ramp that allows users of non-ERC-20 assets to quickly and easily utilize their staked assets by depositing them on the platform to mint a stablecoin known as rUSD.

As a stablecoin issued on the Ethereum blockchain, rUSD can then be used to participate in the extensive Ethereum DeFi ecosystem — without having to exchange the cross-chain assets they deposited as collateral.

If you're in DeFi, check out my partner $RAMP:

– Get a stablecoin in exchange for staked assets

– Deploy that stablecoin into DeFi protocols for additional income streams

– Staked assets redeployed into staking/yield farming to generate passive incomeThere's even more

pic.twitter.com/opa5epUtRi

— The Crypto Dog

(@TheCryptoDog) February 9, 2021

By doing this, users not only maintain their original staking yields from their cross-chain assets, but can also farm RAMP tokens and earn yields from a variety of other DeFi protocols using their stablecoins — allowing users to maximize the yield from their assets.

RAMP has been around for less than six months, but in that time it has managed to generate quite the community and still has a relatively low market cap at ~$30 million. But with the potential to unlock the value of almost $1 trillion worth of cryptocurrency assets, we think there’s plenty of room for further growth.

Disclaimer: The information presented here does not constitute investment advice or an offer to invest. The statements, views, and opinions expressed in this article are solely those of the author/company and do not represent those of Bitcoinist. We strongly advise our readers to DYOR before investing in any cryptocurrency, blockchain project, or ICO, particularly those that guarantee profits. Furthermore, Bitcoinist does not guarantee or imply that the cryptocurrencies or projects published are legal in any specific reader’s location. It is the reader’s responsibility to know the laws regarding cryptocurrencies and ICOs in his or her country.