- Bitcoin has undergone a strong rally higher over the past week, reaching highs of $13,250.

- Looking at derivatives trends, one analyst recently postulated that Bitcoin’s price action may be overheated.

- The aggregated open interest and CVD of BTC futures markets are meeting notable resistances, he noted.

Bitcoin May Be Overheated, Analyst Fears as Funding Rate Moves Higher

Bitcoin has undergone a strong rally higher over the past week. The leading cryptocurrency has shot from $11,200, the lows of last week, to $13,150 as of this article’s writing. That is a gain of 17.5% in the span of ten days.

Many noted that this move was predicated on spot market volumes on exchanges like Coinbase. Many see spot-led rallies as bullish as it indicates the arrival of institutional money or a mass amount of retail capital, or even a mix of both.

But as the rally has petered out in the $12,800-13,200 range, a derivatives influence has begun to appear. Derivatives-led rallies are often seen as less sustainable rallies as eventually, traders will need to close their long positions, resulting in sell pressure.

Looking at derivatives trends, one analyst recently postulated that Bitcoin’s price action may be overheated.

“Further confirmation that derivatives are overheated.”

He shared the chart below on October 24th.

It shows that the aggregated funding rate of leading Bitcoin futures markets is currently inching well into the positive. The funding rate is the fee that long positions pay short positions to keep the price of the future near the price of the spot market. High funding rates often suggest that derivatives markets are driving the market higher, and may need to correct.

The chart also shows that the aggregated open interest and CVD of futures markets are meeting notable resistances.

Chart of BTC's price action over the past few days with an analysis by crypto trader Byzantine General. Source: BTCUSD from TradingView.com and Coinalyze.

Room to Grow

Most are confident, though, that Bitcoin has room to extend to the upside.

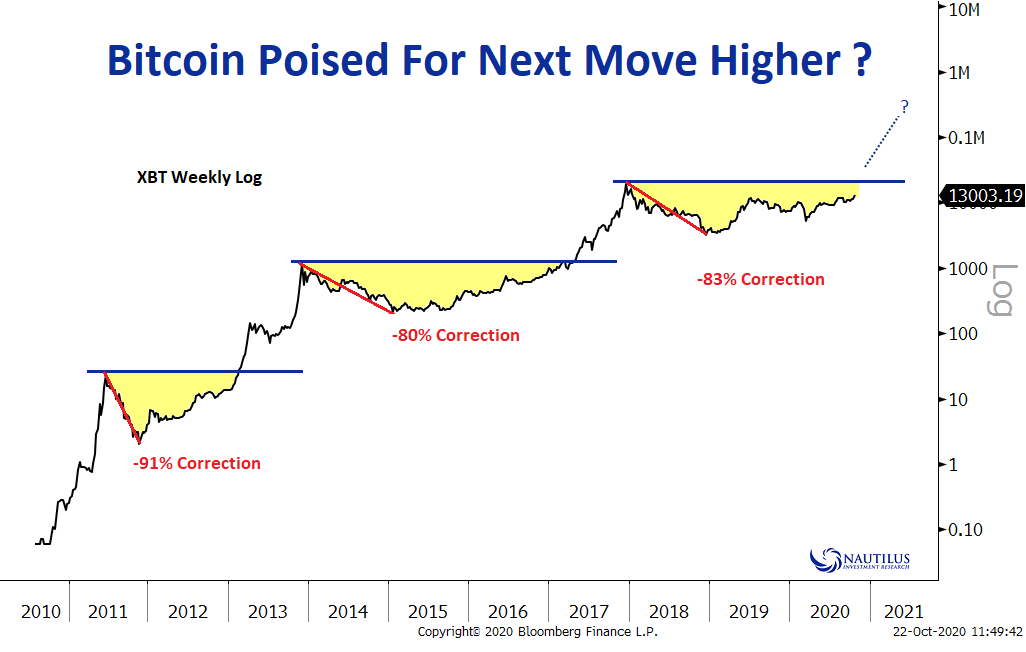

Nautilus Research, an independent research boutique that services institutional investors, thinks that the macro BTC chart looks similar to how it did prior to previous exponential rallies:

“Bitcoin echoes of patterns ahead of previous major breakouts.”

Chart of BTC's price action since 2010 with an analysis by an independent research botique for institutional investors, Nautilus Research

Bitcoin holding above $13,000 into the daily close and also into the weekly close on Sunday is also a positive sign for this market to move higher. BTC hasn’t held above $13,000 on a weekly basis since early 2018.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusd Charts from TradingView.com Are Derivatives Overheated? Bitcoin Funding Rates Begin Inching Up