Recent analyses suggest that a significant portion of the capital flow into Bitcoin exchange-traded funds (ETFs) is driven by arbitrage strategies rather than direct investment from retail traders.

Particularly, Raoul Pal, CEO of Real Vision, has highlighted this trend based on data concerning these funds’ ownership and trading patterns.

Institutional Involvement And Market Movements

Real Vision CEO Raoul Pal highlighted the predominance of arbitrage activities in the current Bitcoin spot ETF environment. His observations are backed by analyses indicating that around two-thirds of the net inflows can be attributed to arbitrage trading, particularly among the top institutional holders of these funds.

Upon examining the behaviors of the largest holders of Bitcoin spot ETFs in the United States, it’s clear that hedge funds and large institutional investors play a pivotal role.

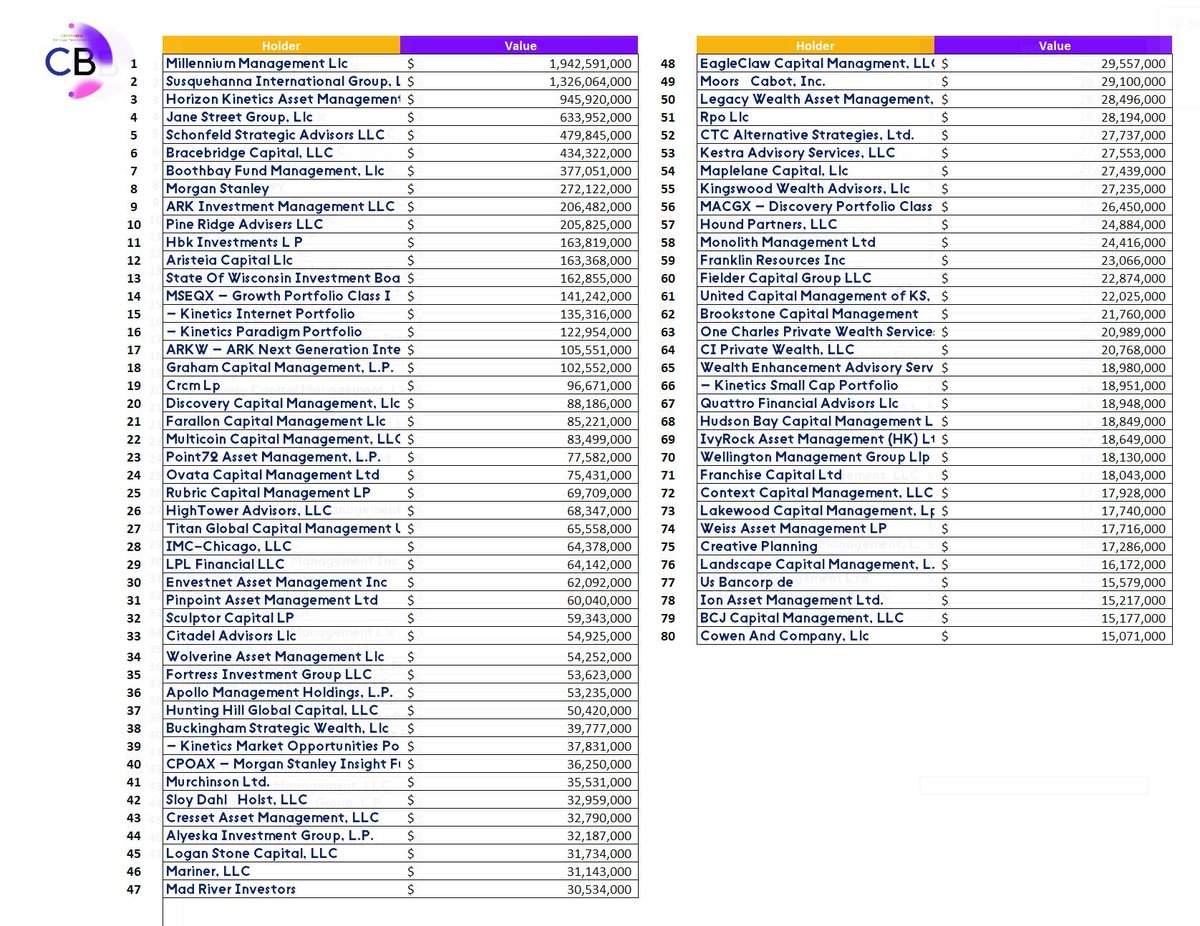

Data shared by Tom Dauvley, a managing partner at MV Capital, shows that the top 80 holders, primarily hedge funds, manage assets amounting to approximately $10.26 billion of the total $15.42 billion in net inflows, representing a significant concentration of market power.

Millennium Management is the largest single holder, with investments spread across multiple ETF issuers, including prominent names like Bitwise, Grayscale, Fidelity, BlackRock, ARK, and 21Shares.

According to Pal, the nature of these inflows points predominantly towards arbitrage. Arbitrage in ETFs involves capitalizing on the price discrepancies between the ETF’s net asset value and the underlying Bitcoin price.

Despite these observations, there is debate about how arbitrage influences overall ETF flows. Some market participants, like Joseph B., a crypto trader, argue that arbitrage might constitute less than 15% of total flows when considering the broader spectrum of US Bitcoin ETFs, which collectively manage over $42 billion in assets.

Hmmmm don’t necessarily agree. Excl GBTC, there is 605,000 BTC ($42 Billion)in ETFs

Short interest on the CME (The only place institutions would be doing their basis trade?) has about 91,000 in BTC ($6 Billion) shorts.

The recent inflows could certainly be attributed to the…

— Joseph B (@Packin_Sats) June 11, 2024

Arbitrage Dominates Bitcoin ETF Landscape

Currently, BTC is priced at $69,523, having increased by 3.5% in the last 24 hours after a recent CPI report indicating a slowing down in inflation in the US. Notably, this performance from BTC marks a recovery from a week-long decline in value.

Before this price move, US spot Bitcoin ETFs saw significant net outflows, with a total of $200 million withdrawn on Tuesday, continuing a pattern from earlier this week that halted a streak of net inflows.

Grayscale’s Bitcoin Trust (GBTC) experienced the highest withdrawals of roughly $121 million, while Ark Invest’s ARKB reported $56 million in net outflows.

Data from SoSoValue also shows that Bitwise’s BTC ETF (BITB) saw a $12 million exit, and both Fidelity and VanEck noted smaller outflows in the single digits. Meanwhile, BlackRock’s IBIT did not report any net flows that day.

So far, the streak of continuous net inflows into the 11 U.S. spot Bitcoin ETFs concluded on Monday after 19 days, resulting in outflows of nearly $65 million. From their inception in January, these ETFs have cumulatively amassed net inflows totaling $15.42 billion.

Featured image created with DALL-E, Chart from TradingView