Bitcoin enthusiasts faced a roller coaster ride this Tuesday as the leading cryptocurrency took a nearly 5% tumble, dipping below $68,000. This sharp decline erased the gains made during a bullish run that saw BTC touch $71,950 just last week. Analysts are scrambling to decipher the reasons behind the sudden skid and predict Bitcoin’s next move, with the highly anticipated Federal Open Market Committee (FOMC) meeting looming large.

Risk Aversion Reigns As Investors Eye FOMC, Inflation Data

The crypto market seems to be mirroring the broader financial landscape, where a cautious mood prevails. Investors are adopting a “risk-off” approach as they brace for the release of crucial economic data, including the Consumer Price Index (CPI) and the FOMC meeting.

The CPI report, a key inflation gauge, is expected to shed light on the state of the US economy. The FOMC meeting, where the Federal Reserve will decide on interest rates, is another major event that could significantly impact investor sentiment.

The upcoming week presents a perfect storm for riskier assets like Bitcoin. The combination of potential interest rate hikes and inflation concerns is putting a damper on investor appetite. This risk aversion is likely translating into outflows from Bitcoin, leading to the price drop we’re witnessing.

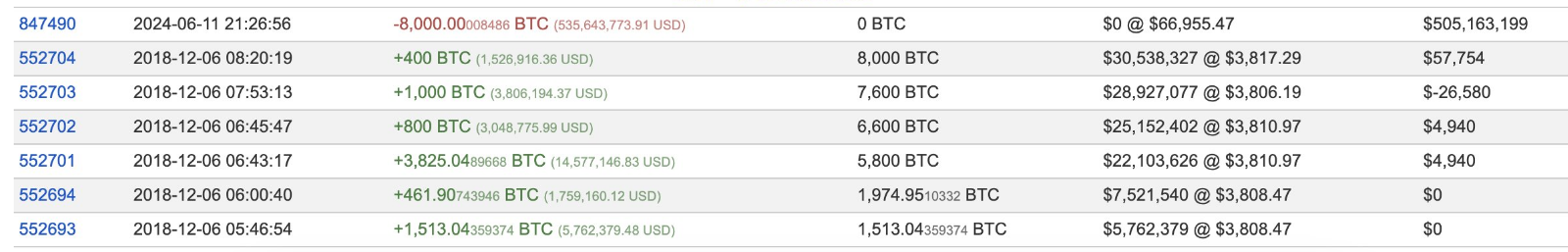

A wallet that had been dormant for 5.5 years transferred 8K $BTC($535.64M) to #Binance 40 mins ago.

The wallet received 8K $BTC on Dec 6, 2018, when the $BTC price was $3,810.https://t.co/zvxAKbHKi6 pic.twitter.com/ZKZHdm4JkR

— Lookonchain (@lookonchain) June 11, 2024

Dormant Bitcoin Wakes Up, Adding Fuel To The Fire

Adding another layer of intrigue to the price movement was a large Bitcoin transfer that occurred earlier on Tuesday. A wallet that had been dormant for over five years suddenly sprang to life, transferring a whopping 8,000 BTC, valued at over half a billion dollars, to several addresses, including the prominent cryptocurrency exchange Binance. The sudden movement of such a large amount of Bitcoin could have triggered some short-term volatility in the market.

Analysts Share Views On Bitcoin’s Post-FOMC Trajectory

Analysts Share Views On Bitcoin’s Post-FOMC TrajectoryWhile the immediate future appears uncertain, some analysts remain optimistic about Bitcoin’s long-term prospects. Markets are “risk-off mode ahead of CPI and FOMC tomorrow,” commented analysts at QCP Capital, a global digital asset trading firm and market maker.

3/

3. Markets are risk-off mode ahead of CPI and FOMC tomorrow. This month’s FOMC will also release the Dot Plot, which informs the market how many cuts the Fed anticipates for the rest of 2024.

— QCP (@QCPgroup) June 11, 2024

This sentiment is echoed by some crypto analysts on social media. Popular figures like Moustache and Max pointed out historical instances where FOMC meetings coincided with price dips followed by bullish reversals.

Last 3 FOMC meetings marked out over $BTC‘s price action.

We’ve seen this before. pic.twitter.com/GQhTLV5pll

— Max (@MaxBecauseBTC) June 11, 2024

Featured image from Pexels, chart from TradingView