Bitcoin has regained momentum. At the time of writing, BTC trades at $57,225 with a 1.5% profit in the daily chart and sideways movement in the lower timeframes.

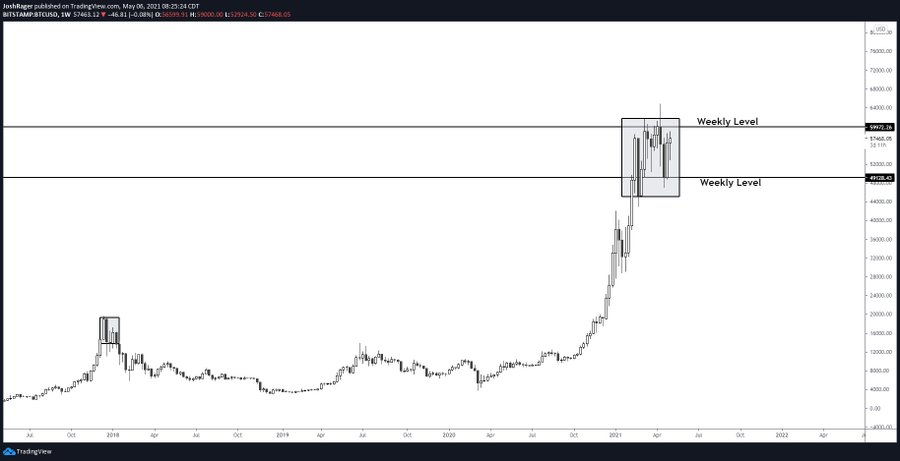

The general sentiment in the market is divided, investor’s attention seems to have gone towards Ethereum (+27.3%) and Dogecoin (+88.4%), cryptocurrencies with impressive rallies in the 7-day chart. Trader Josh Rager believes BTC’s price action in the past 3 months, ranging between $45,000 to $60,000, is a signal that there is potential for another leg-up.

Rager added that there has been an important interest from retail investors towards DOGE. The same effect could soon affect BTC, as it did during 2017’s bull-run, and “provide some solid exit liquidity for big player”. If BTC closes the weekly candle above $60,000, it could go into price discovery, as the chart below shows.

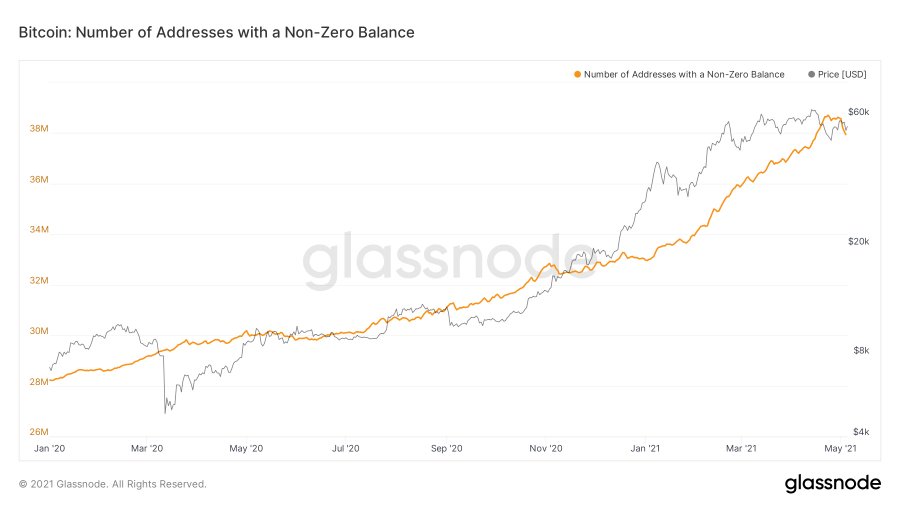

However, BTC retail investors could be behind the cryptocurrency sideways price action. Researcher Jan Wuestenfeld registered a decrease in Addresses with a Non-Zero balance suggesting retail has been selling their coins or moving them to exchange platforms, as shown below.

Conversely, there has been an increase in Binance BTC supply. Wuestenfeld claims the following:

The bitcoin balance on Binance has been going upwards heavily. So it could be that retail is depositing their Bitcoin on e.g. Binance to sell their $BTC to speculate in altcoins. That would also fit with the recent rise in $ETH’s price.

Whales On The Offensive Absorb Bitcoin’s Dip

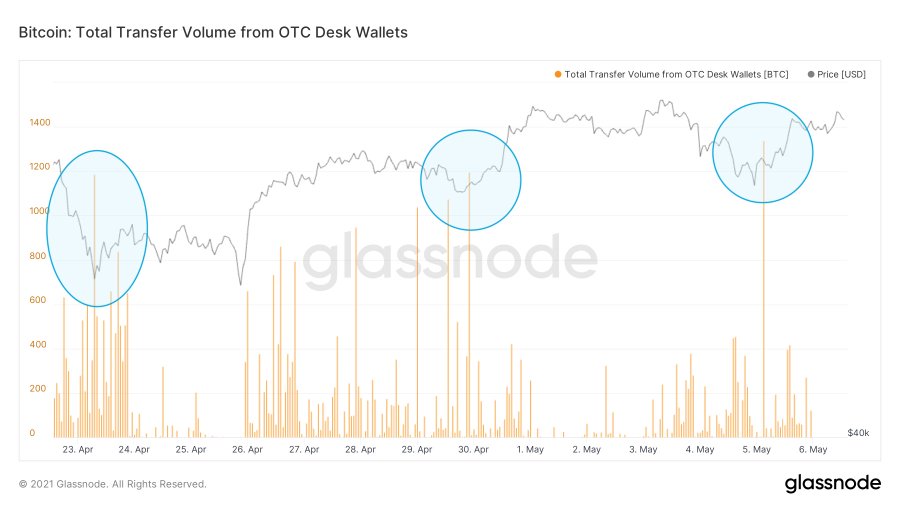

Bitcoin’s whales behave differently. Chief Investment Officer for Moskovski Capital, Lex Moskovski, has registered an increase in the Total Transfer Volume from Over-the-Counter Desk. Attributed to large investors and institutions looking to accumulated BTC, there is an increase in this metric every time BTC’s price has dropped since April 23rd, 2021.

Fund manager at Ikigai Asset Management, Travis Kling, believes BTC’s 3 months consolidation phase points towards more appreciation. He claims there is “zero” chance that this period will end up at a local top. The current price action could be BTC warming up to reach new highs, as it did in the past.

In reply to these claims, Oliver Renick, lead anchor at TD Ameritrade Networks, pointed out the main difference in this Bitcoin bull-run and past years: a dropped in the cryptocurrency’s volatility. Either because BTC has lost “utility” or as a sign of a maturing stable asset. Renick said:

(…) From January to March, bitcoin quickly found buyers at each successively shallower dip, but eventually ran out of buyers willing to pay more than $60,000. When someone finally did, traders quickly took advantage of it as a selling opportunity.