The crypto market has been struck by the bears. In 24-hours, Bitcoin and the major cryptocurrencies have seen a price correction. The king itself dropped almost 20% to the mid $40,000 range before showing sing of a recovery.

At the time of writing, BTC trades at $48,546 with a 12.3% in the daily chart a 3.6% loss in the 1-hour chart. Higher timeframes make up for a bearish outlook. The 7-day and 30-day charts are in the red with a 15.7% and 19.2% loss, respectively.

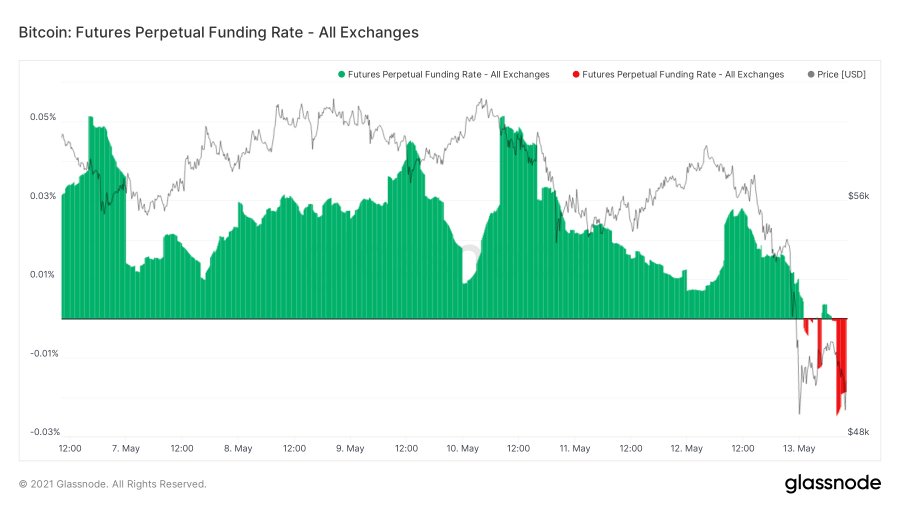

The market seems to have been bombarded by several bearish news, now taking its toll on price action. Traders went from greed to fear in a short span of time. BTC’s futures operators took on short positions, expecting the price to dip further, as Moskovski Capital CIO Lex Moskovski stated.

The market was net-short with funding rates across all exchanges platform on a negative, for the first time in May. Data from CryptoMeter points suggest that the short positions are dominating the market as BTC’s price climbs down to critical support at $47,000.

In the past day, Short positions worth over $1 billion have been recorded. Binance holds a big portion of these positions with an estimated worth of $383.9 million versus 359.4 million on the other side of the trade.

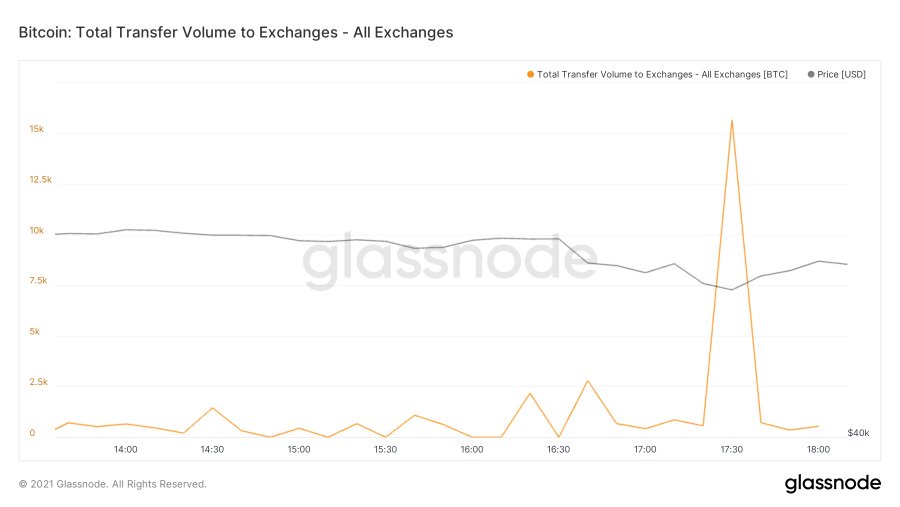

The bearish sentiment is backed by a spike in BTC inflows into exchanges. Around 15,662 BTC were moved to these platforms in the last hour. Moskovski said the following:

Depositing doesn’t necessarily mean selling. It can easily be spoofing. As well, as an internal transfer that GN hasn’t caught.

This could provide the bears with fresh ammunition. However, analyst William Clemente supports Moskovski and claims that the inflows remain unspent and could be exchanged’s internal transfers.

Bitcoin’s Price Unhurt By Elon Musk FUD

Anonymous Trader Daan Crypto shared a BTC’s price-ranging formation that presents similarities with the current price action. At that moment, Bitcoin went through a correction and reach the yearly Volume Weighted Average Price, a benchmark that measures the average trading volume and price oscillation, and bounced back towards an all-time high.

However, current price action seems to be favoring the bears, at least in the short term. Senior Commodity Strategist for Bloomberg Intelligence, Mike McGlone, believes there is more upside in BTC’s price compared to Elon Musk-led company Tesla.

Musk’s statements on BTC mining as a detrimental activity for the environment are believed to have triggered the sell-off. In the long term, Bitcoin maintains its bullish outlook, as McGlone stated:

Ironic Tesla Shift Doesn’t Hurt Bitcoins Relative Upper Hand. Tesla CEO Elon Musk’s curious move to suspend purchases using Bitcoin doesn’t shake our call that the crypto has the upper hand vs. the electric-vehicle maker’s shares.

The #Tesla vs. #Bitcoin performance dual may mark an inflection point, with macroeconomic underpinnings. Both consume a lot of electricity, which is getting greener and should diminish as a Bitcoin criticism, and extols the defensive benefits of its decentralized computer network pic.twitter.com/Ii4vMUJmFJ

— Mike McGlone (@mikemcglone11) May 13, 2021