Data from Glassnode shows an additional 32.3% of the Bitcoin supply has entered into a state of profit with the rally in 2023 so far.

About 77% Of The Total Bitcoin Supply Is Now In Profit

According to the latest weekly report from Glassnode, a total of 6.2 million BTC has come back into the green this year. The relevant indicator here is the “percent supply in profit,” which tells us what percentage of the Bitcoin supply is currently carrying some amount of unrealized profit.

The metric works by going through the on-chain history of each coin in the circulating supply and checking what price it was last moved at. If this previous price for any coin was less than the current BTC value, then that specific coin is carrying a profit right now, and the indicator adds it to its value.

Related Reading: Bitcoin Dips Below $30,000 Following Overheated Futures Market

Generally, the higher the value of the percent supply in profit, the more likely are the investors to sell and harvest some of the gains they have accumulated. Because of this reason, tops become more likely to form as the metric’s value rises.

On the other hand, low values of the indicator imply a large amount of the supply is in loss currently, and hence, the holders don’t have much incentive to sell their coins.

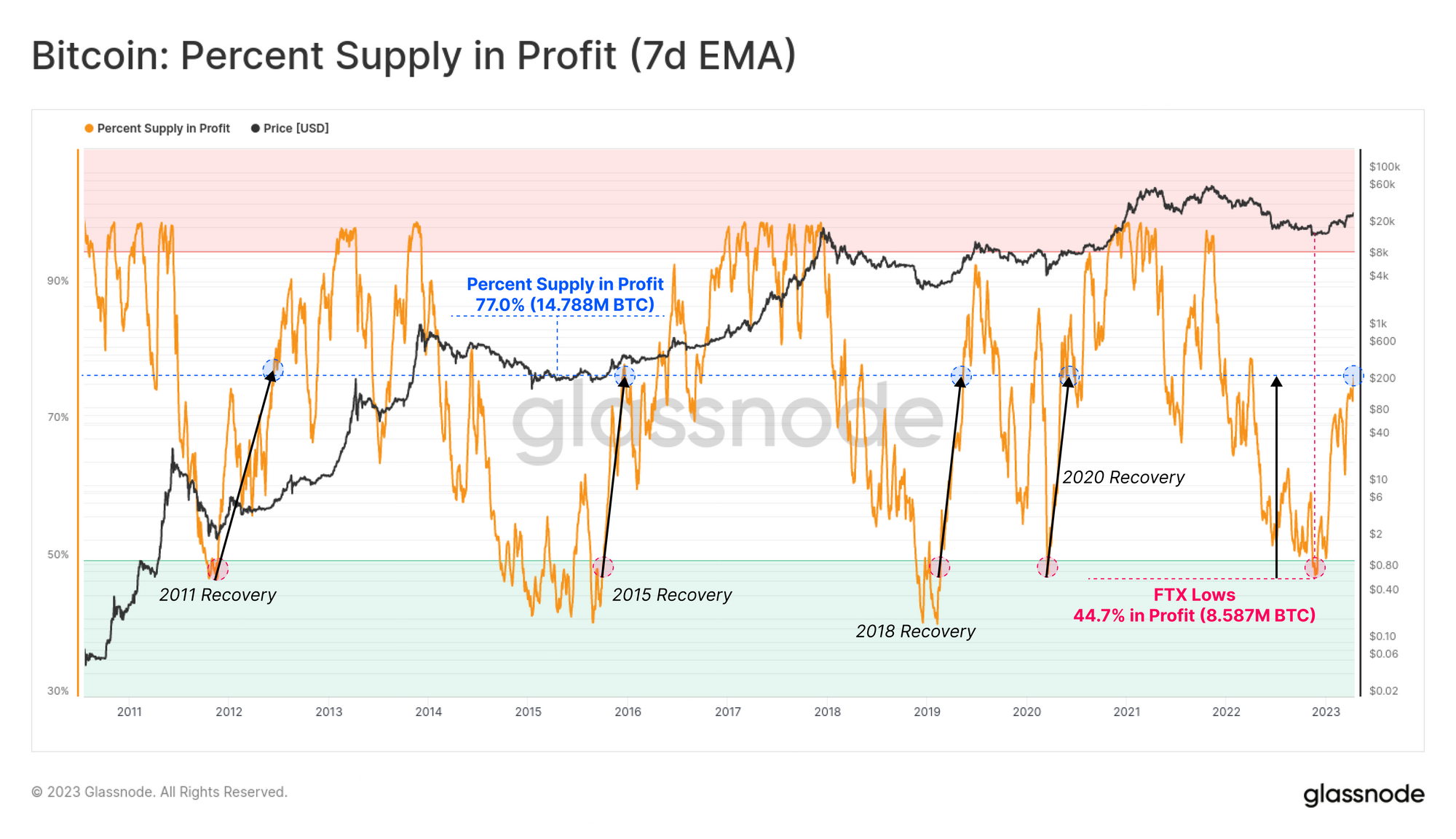

Now, here is a chart that shows the trend in the 7-day exponential moving average (EMA) Bitcoin percent supply in profit over the entire history of the cryptocurrency:

As displayed in the above graph, the 7-day EMA Bitcoin percent supply had plunged to pretty low levels during the bear market last year as multiple crashes put a large number of investors underwater.

The indicator hit its lowest point following the crash due to the collapse of the cryptocurrency exchange FTX, as just 44.7% of the supply (about 8.6 million BTC) remained within profit.

With the start of the rally this year, however, the metric has naturally shown some strong recovery, and a total of about 77% of the Bitcoin supply (14.8 million BTC) is in profit now.

Compared to the start of the year, an additional 6.2 million BTC has come into a state of profit, representing around 32.3% of the total BTC supply. This heavy rise suggests that a large amount of the supply changed hands below the current price level.

Historically, bear market bottoms have formed when investors have capitulated after entering into deep losses. This is because during such capitulation events, the supply these underwater investors were previously holding moves into the hands of holders with a stronger conviction.

The latest trend in the supply in profit could suggest that such a detox may have taken place now, as a large amount of the holders now have their cost basis at the lower, bear market prices.

BTC Price

At the time of writing, Bitcoin is trading around $29,900, up 1% in the last week.